Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

If you’re building a portfolio or just trying to make sense of where to park your money, the debate between stocks and bonds comes up all the time. Managing everything from personal retirement accounts to advising on corporate funds, and one thing’s clear: understanding these two assets isn’t just academic—it’s crucial for protecting your wealth and chasing growth. Stocks offer the thrill of ownership and big upside potential, while bonds provide a steadier path with reliable income. But how do they really stack up? In this deep dive, we’ll unpack the key differences, backed by insights from top financial experts, to help you decide what’s best for your goals. Whether you’re a beginner eyeing your first investment or a seasoned trader rebalancing, let’s break it down.

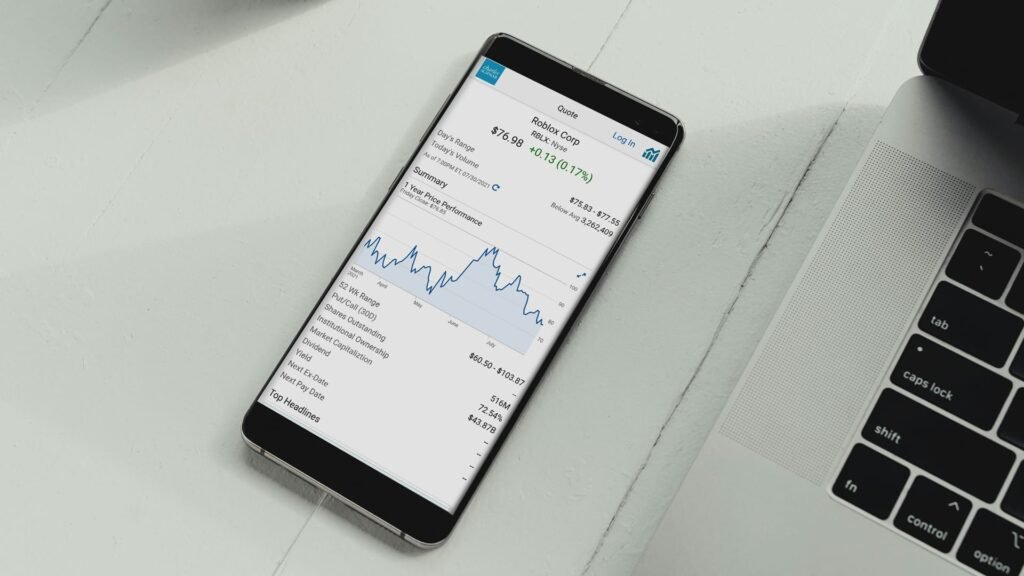

Stocks, often called equities, represent a slice of ownership in a publicly traded company. When you buy shares, you’re essentially becoming a partial owner—think of it as claiming a piece of the pie in giants like Apple or emerging players in tech. Companies issue stocks to raise capital for expansion, R&D, or paying down debt, and these shares trade on exchanges like the NYSE or Nasdaq.

From my experience, stocks shine when markets are booming. Their value can climb based on company performance, economic trends, or even hype around new products. Returns come in two main flavors: capital gains (selling shares for more than you paid) and dividends (periodic payouts from profits). But here’s the catch—they’re not guaranteed. If the company hits rough patches, like during the 2020 downturn, share prices can plummet. Historically, though, stocks have delivered average annual returns around 7-10% after inflation, making them a powerhouse for long-term growth.

Bonds flip the script—they’re more like IOUs. When you invest in a bond, you’re lending money to a government, municipality, or corporation for a fixed period. In return, you get regular interest payments (called coupons) and your principal back at maturity, which could be anywhere from a few months to 30 years.

I’ve seen bonds act as the anchor in volatile times; they’re designed for stability. Governments like the U.S. Treasury issue them to fund operations, while companies use them for big projects without diluting ownership. Bond prices can fluctuate with interest rates—if rates rise, existing bonds with lower yields lose appeal and drop in value. But high-quality bonds, especially Treasuries, are seen as low-risk havens. Average returns hover around 3-5%, focusing on preservation rather than explosive growth.

At their core, stocks and bonds differ in structure, risk, and reward—think ownership versus lending. Stocks tie you to a company’s fortunes, offering unlimited upside but no safety net. Bonds promise fixed payments, prioritizing predictability over potential.

Ownership is a big divider: Stockholders vote on company matters and claim assets if things go south, but bondholders are creditors with priority in bankruptcy. Risk-wise, stocks swing with market moods, while bonds face threats from inflation or issuer defaults. Returns reflect this—stocks chase high growth, bonds deliver steady income.

To make it clearer, here’s a side-by-side comparison based on real-world data I’ve pulled from years of market watching:

| Aspect | Stocks | Bonds |

|---|---|---|

| Ownership | Partial company ownership | Lender to issuer (no ownership) |

| Returns | Capital gains + dividends (variable, higher potential) | Interest payments + principal (fixed, lower average) |

| Risk Level | High volatility, market-dependent | Lower, but sensitive to rates and credit |

| Maturity | No fixed end date | Set maturity date |

| Income | Dividends (not guaranteed) | Coupons (regular, predictable) |

| Tax Treatment | Capital gains tax on sales | Interest often taxable, some exempt (e.g., munis) |

| Best For | Growth-oriented investors | Income seekers, risk-averse |

This table isn’t exhaustive, but it highlights why diversifying across both can smooth out rides—stocks for punch, bonds for ballast.

Stocks have powered many fortunes, but they’re not for the faint-hearted. On the plus side, they offer inflation-beating growth; over decades, the S&P 500 has averaged about 10% annually. Dividends from blue-chips like Procter & Gamble provide passive income, and liquidity is top-notch—you can sell shares instantly during market hours.

Drawbacks? Volatility is brutal. I’ve watched clients sweat through 20-30% drops in bear markets, like 2008 or 2022. No guarantees mean you could lose big if a company flops, and emotional trading often amplifies losses. Still, for young investors with time on their side, stocks are unmatched for compounding wealth.

Bonds appeal to those craving reliability. Their biggest win is steady income—think retirees clipping coupons from Treasuries yielding 4-5%. They’re safer, especially investment-grade ones, with lower default rates than junk bonds. In portfolios, they counter stock crashes; when equities tank, bond prices often rise as rates fall.

Cons include modest returns that might not outpace inflation, eroding purchasing power. Interest rate hikes can tank values if you sell early, and credit risk looms with shakier issuers. Yet, for conservative folks or short-term goals, bonds are a smart buffer.

Choosing boils down to your timeline, risk tolerance, and objectives. If you’re under 40 with steady income, lean toward stocks—time lets you ride out dips for higher rewards. Nearing retirement? Bonds’ stability preserves capital. A classic 60/40 split (stocks/bonds) balances both, adjusting as you age.

From advising hundreds, I’d say assess your gut: Can you handle a 50% portfolio drop? If not, bonds more. Tools like Vanguard’s investor questionnaire help quantify this. Ultimately, blend them—diversification wins.

Stocks and bonds aren’t rivals; they’re teammates in a solid investment strategy. Stocks fuel growth, bonds add security—together, they weather storms and build wealth. I’ve built portfolios that thrived by respecting these differences, and you can too. Start small, educate yourself, and consult a advisor if needed. What’s your take—team stocks, bonds, or both? Share below, and let’s discuss tailoring this to your situation.

Disclaimer: Investing involves risks, including loss of principal. This isn’t personalized advice; seek professional guidance.