Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

If you’ve ever watched the stock market swing wildly from one day to the next, you’ve likely encountered market volatility firsthand. It’s that unpredictable force that can turn a calm trading session into a rollercoaster ride. But what exactly is market volatility, and why should it matter to you as an investor? In this guide, we’ll break it down step by step, drawing from real-world examples and proven strategies to help you navigate these turbulent waters. Whether you’re a seasoned trader or just starting out, understanding volatility can be the key to protecting your portfolio and spotting opportunities.

Market volatility refers to the rate at which the price of securities or the overall market fluctuates over a short period. Think of it as the market’s “mood swings”—prices can soar or plummet based on a mix of economic data, geopolitical events, or even investor sentiment. Unlike steady, predictable growth, volatility measures how much prices deviate from their average, often signaling uncertainty in the financial world.

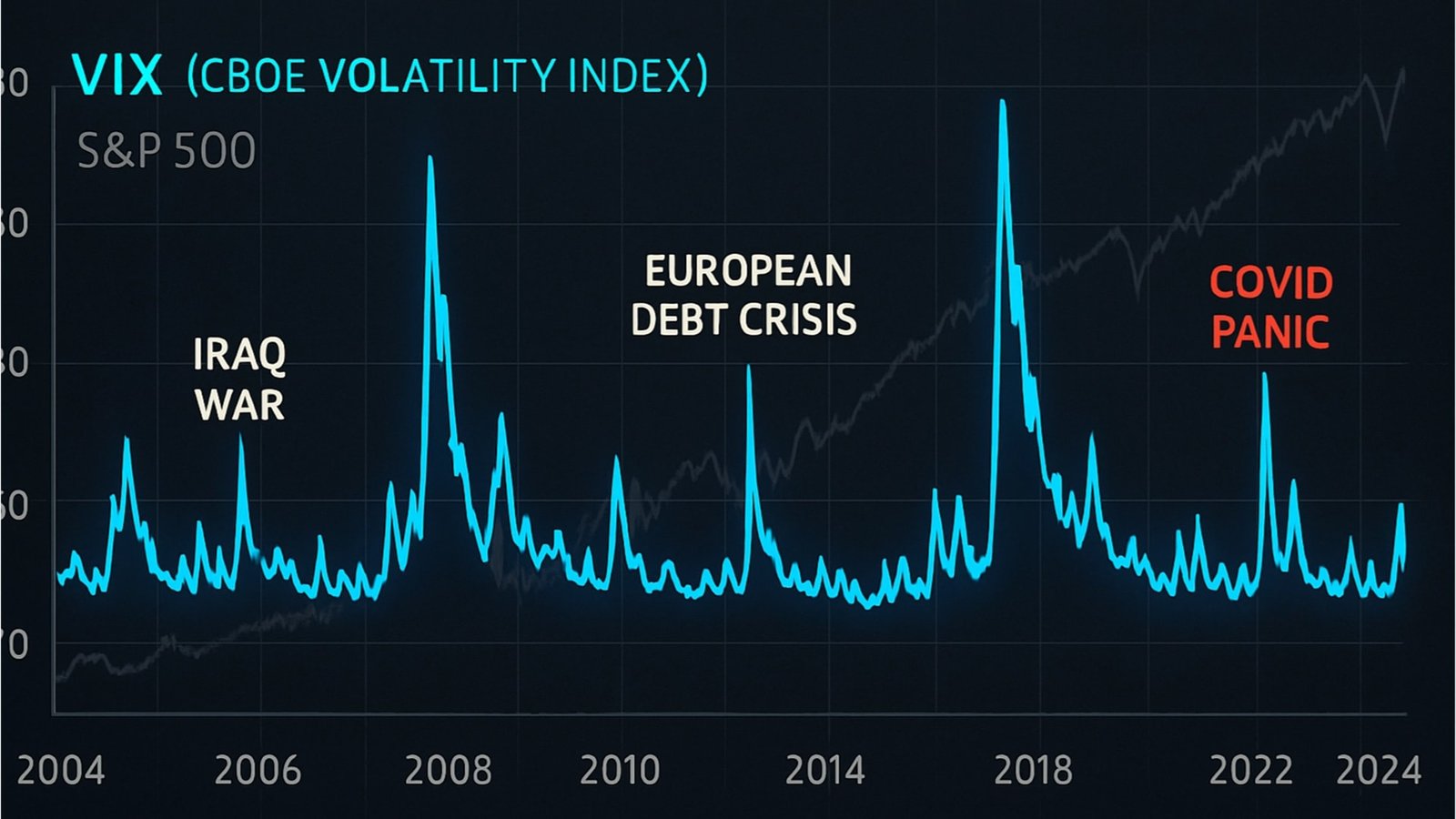

Historically, we’ve seen extreme volatility during events like the 2008 financial crisis or the COVID-19 market crash in 2020. For instance, the S&P 500 dropped over 30% in a matter of weeks during the pandemic, only to rebound sharply as stimulus measures kicked in. This isn’t just abstract theory; it’s the reality that affects retirement accounts, stock picks, and even global economies. Volatility isn’t inherently bad—it’s a natural part of investing—but ignoring it can lead to costly mistakes.

To make sense of volatility, investors rely on specific tools and metrics. The most common is the Volatility Index (VIX), often called the “fear gauge,” which tracks expected volatility in the S&P 500 over the next 30 days. When the VIX spikes above 20, it usually indicates heightened market anxiety.

Other key measures include standard deviation, which calculates how much prices vary from the mean, and beta, which compares a stock’s volatility to the broader market. A beta of 1 means the stock moves in line with the market; anything above suggests higher risk.

Here’s a quick comparison of popular volatility indicators in a table for clarity:

| Indicator | Description | Typical Use Case | Example Value Interpretation |

|---|---|---|---|

| VIX (CBOE Volatility Index) | Measures implied volatility from S&P 500 options prices. | Gauging short-term market fear. | Below 15: Low volatility; Above 30: High stress. |

| Standard Deviation | Statistical measure of price dispersion over a period (e.g., 1 year). | Assessing historical volatility for individual stocks. | Higher value = Greater price swings. |

| Beta | Compares a security’s volatility to the market (e.g., S&P 500 as benchmark). | Portfolio risk management. | Beta >1: More volatile than market; Beta <1: Less volatile. |

| ATR (Average True Range) | Tracks the average range between high and low prices over time. | Day trading and stop-loss placement. | Used to set dynamic trading thresholds. |

These tools aren’t just for Wall Street pros; apps like Yahoo Finance or TradingView make them accessible to anyone. By monitoring them, you can get a pulse on whether the market is in a calm phase or gearing up for turbulence.

Volatility isn’t just a buzzword—it’s a critical factor that influences everything from your investment returns to your emotional well-being. High volatility can erode gains quickly if you’re not prepared, but it also creates buying opportunities for those who stay level-headed. During volatile periods, blue-chip stocks might dip temporarily, allowing savvy investors to scoop them up at a discount.

From a risk management perspective, volatility matters because it amplifies potential losses. If your portfolio is heavy on high-volatility assets like tech stocks, a sudden downturn could wipe out months of progress. That’s why diversification—spreading investments across stocks, bonds, and even commodities—becomes essential. Bonds, for example, often act as a buffer when stocks are volatile, providing stability during market storms.

On the flip side, volatility can be a boon for active traders. Options strategies, like straddles or strangles, thrive in uncertain environments by betting on big price moves without predicting direction. But for long-term investors, the focus should be on weathering the storm rather than chasing highs. Studies from firms like Vanguard show that investors who panic-sell during volatile times often miss out on subsequent recoveries, locking in losses unnecessarily.

What drives these fluctuations? Economic indicators like inflation reports, interest rate changes from the Federal Reserve, or unemployment data can spark immediate reactions. Geopolitical tensions—think trade wars or elections—add another layer of unpredictability. In 2022, for instance, Russia’s invasion of Ukraine sent energy prices skyrocketing, boosting volatility across global markets.

Investor behavior plays a huge role too. Herd mentality, where everyone rushes to buy or sell based on headlines, can exaggerate swings. Algorithmic trading, which now dominates markets, can amplify this by executing trades in milliseconds based on predefined triggers. Understanding these triggers helps you anticipate volatility rather than react to it.

So, how do you turn volatility from a threat into an ally? Start with a solid plan. Dollar-cost averaging—investing fixed amounts regularly regardless of price—smooths out the impact of swings over time. It’s a strategy backed by decades of data, helping investors avoid the pitfalls of timing the market.

For those with more experience, hedging with options or ETFs like the VIX futures can provide insurance against downturns. Rebalancing your portfolio quarterly ensures you don’t drift into overly risky territory. And always, always maintain an emergency fund outside the market to avoid forced sales during dips.

If volatility feels overwhelming, consider consulting a financial advisor. They can tailor strategies to your risk tolerance, ensuring you’re not overexposed. Remember, the goal isn’t to eliminate volatility—that’s impossible—but to manage it in a way that aligns with your long-term objectives.

Ultimately, market volatility matters because it tests your discipline as an investor. It separates those who react emotionally from those who stick to data-driven decisions. By grasping what volatility is and why it occurs, you’re better equipped to protect your wealth and seize opportunities.

If you’re deciding on your next move, ask yourself: Does my portfolio reflect my risk appetite? Am I diversified enough? Tools like the ones mentioned can help you answer these. In volatile markets, patience often pays off—history shows that markets trend upward over time, rewarding those who endure the bumps.

Stay informed, stay strategic, and volatility won’t catch you off guard. For more insights, keep an eye on reliable sources like the SEC’s investor education site or financial news from Bloomberg. Investing is a marathon, not a sprint, and understanding volatility is your edge in the race.