Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

In an economy that’s always in flux, the word “recession” often sparks worry—especially when headlines buzz about slowing growth or rising unemployment. As someone who’s guided clients through multiple economic cycles over the years, I’ve seen firsthand how being proactive can turn potential hardship into a manageable phase. Whether you’re worried about job security, shrinking savings, or market dips, understanding what a recession entails and how to brace for it is your first line of defense. This guide draws on reliable insights from financial experts and recent trends to help you navigate these challenges, offering clear steps to protect your wealth and peace of mind. By focusing on practical preparation, you can emerge stronger, no matter what the economy throws your way.

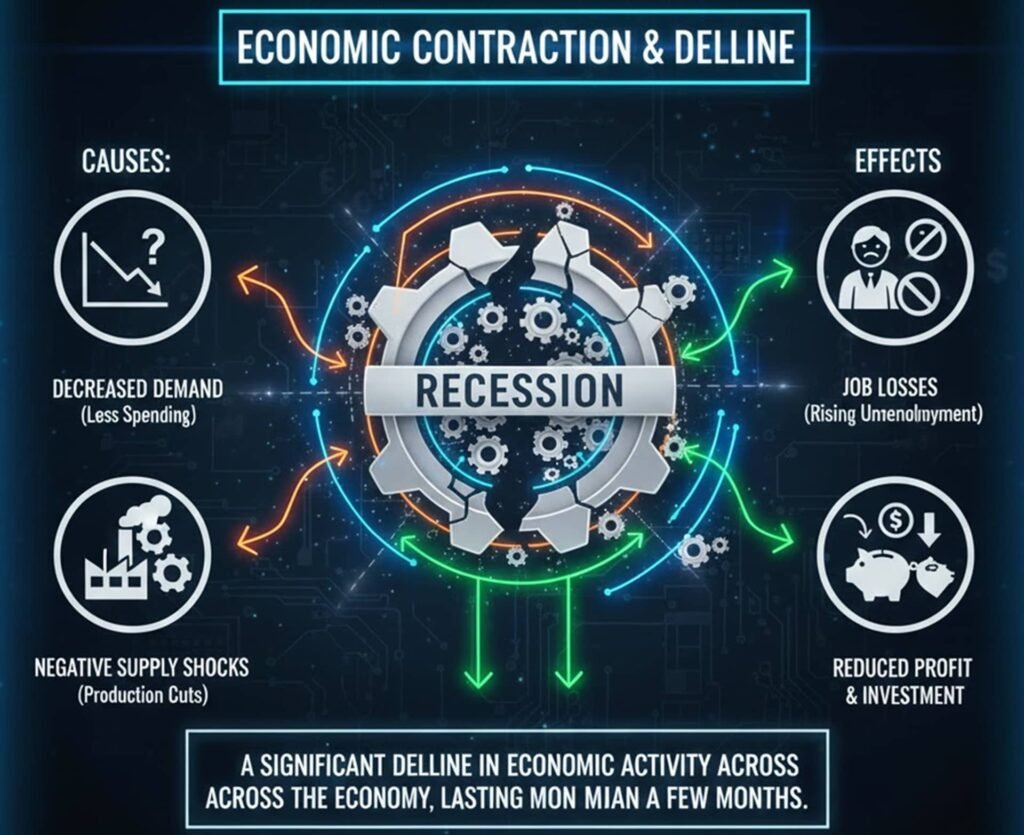

A recession isn’t just a buzzword—it’s a prolonged slowdown in economic activity that ripples through jobs, businesses, and daily life. Technically, it’s often marked by two consecutive quarters of declining gross domestic product (GDP), but experts like the National Bureau of Economic Research (NBER) look deeper at factors such as employment drops, reduced industrial output, and waning consumer spending. In simpler terms, it’s when the economy contracts, leading to less money circulating, fewer opportunities, and tougher times for many.

From my experience, recessions vary in severity—some are mild and short-lived, lasting just a few months, while others drag on for years, amplifying inequality and stress. They’re a natural part of economic cycles, following booms where growth overheats. Right now, in late 2025, with lingering inflation concerns and volatile job reports, whispers of a potential downturn remind us why preparation matters more than prediction.

Recessions don’t strike randomly; they’re often ignited by a mix of internal and external pressures. High inflation, for instance, prompts central banks like the Federal Reserve to hike interest rates, making borrowing costlier and curbing spending by consumers and companies alike. This can snowball into reduced production, layoffs, and a broader slowdown. Other culprits include financial crises, where market bubbles burst—like the housing crash of 2008—or global shocks such as pandemics, supply chain snarls, or geopolitical tensions that disrupt trade.

In my advisory work, I’ve noticed that overleveraged debt often plays a role, too. When businesses or households are stretched thin, even a small hike in rates can tip the balance. Add in natural disasters or political instability, and you have a recipe for contraction. Understanding these triggers helps spot patterns early, giving you time to adjust before the full impact hits.

Catching a recession early isn’t foolproof, but certain indicators flash red flags worth watching. Rising unemployment is a big one—tools like the Sahm Rule trigger when the three-month average jobless rate climbs 0.5 percentage points above its recent low. An inverted yield curve, where short-term bonds yield more than long-term ones, has predicted nearly every U.S. recession since the 1950s. Other signs include slumping stock markets, declining consumer confidence, reduced manufacturing activity, and slower home sales.

Here’s a quick overview of key recession indicators and what they signal:

| Indicator | Description | Implication for the Economy |

|---|---|---|

| Inverted Yield Curve | Long-term bond yields drop below short-term ones due to investor caution. | Signals lost faith in short-term growth; often precedes recessions by 12-18 months. |

| Rising Unemployment | Jobless rates increase, with tools like the Sahm Indicator alerting at 0.5% rises. | Points to weakening labor market; leads to less spending and deeper slowdowns. |

| Declining GDP | Two straight quarters of negative growth in goods and services output. | Confirms contraction; hits employment and output hard. |

| Stock Market Volatility | Sharp drops or bear markets (20%+ declines) amid uncertainty. | Reflects investor fear; can exacerbate business cutbacks. |

| Falling Consumer Spending | Reduced retail sales and confidence surveys show pullback. | Slows business revenues, prompting layoffs and inventory cuts. |

Monitoring these through sources like the Fed’s reports or financial news can give you a head start. In 2025, with job openings down and inflation lingering, some of these are already flickering, urging vigilance without panic.

When a recession takes hold, the effects cascade. On a macro level, GDP shrinks, businesses shutter or scale back, and governments face deficits from lower tax revenues and higher welfare demands. Unemployment surges, sometimes doubling, while inflation might ease but at the cost of stagnant wages. Stock markets tumble, eroding retirement savings, and credit tightens, making loans harder to get.

For individuals, it’s personal: job loss or reduced hours strain budgets, forcing tough choices like dipping into savings or racking up debt. Investments take a hit—I’ve seen clients lose 20-30% in portfolios during dips—but those who sell in fear often miss the rebound. Families might delay big purchases, cut vacations, or even face foreclosure risks. The psychological toll is real, too, breeding anxiety that leads to poor decisions. Yet, recessions also create opportunities, like cheaper assets for savvy buyers, reminding us that recovery always follows.

Preparation isn’t about predicting doom—it’s about creating buffers that let you weather the storm. Based on strategies I’ve implemented with clients, start with these essentials, tailored to your situation.

First, shore up your emergency fund. Aim for six to 12 months of living expenses in a high-yield savings account—more if your industry is volatile. This cash cushion covers basics if income drops, without touching investments at lows.

Next, tackle high-interest debt aggressively. Prioritize credit cards (often over 20%) using methods like the debt avalanche—paying off highest rates first—to free up cash flow. Avoid new debt by budgeting ruthlessly: track every expense, cut non-essentials like subscriptions, and redirect savings to your fund.

Diversify your income streams. A side gig—freelancing, renting out space, or gig economy work—can provide a safety net. Keep your resume polished and network regularly; in tough markets, connections open doors faster.

For investments, stick to your long-term plan. A diversified portfolio—mixing stocks, bonds, and real assets—helps mitigate losses. Resist panic selling; history shows markets recover, often sharply after bottoms.

Finally, review your overall financial plan with a professional. Stress-test it for scenarios like unemployment, and consider insurance gaps. Protect against fraud by monitoring accounts and freezing credit if needed.

Looking back, the 2008 financial crisis showed how housing bubbles can devastate, with unemployment peaking at 10% and millions losing homes. Yet, those who held investments saw the S&P 500 quadruple in the following decade. The 2020 COVID recession, brief but sharp, highlighted supply chain vulnerabilities but also quick rebounds aided by stimulus. These events underscore that recessions end—averaging 10 months since WWII—and preparation, not timing, is key. In today’s 2025 landscape, with tech shifts and global tensions, the same principles apply: resilience wins.

A recession might feel inevitable at times, but with a solid grasp of its mechanics and targeted prep, you can minimize its bite and even spot upsides. Start today by auditing your budget, bulking up savings, and consulting an advisor—small actions compound into big security. Remember, economies recover, and so do prepared individuals. If you’re facing uncertainty, take that first step; your financial future depends on it.