Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

In the shadow of America’s towering $38.4 trillion national debt as of early 2026, a subtle yet profound shift is reshaping the financial landscape. For the first time in history, the U.S. government’s interest payments on this debt have surpassed spending on national defense, clocking in at a staggering $970 billion for fiscal year 2025. This isn’t just a fiscal anomaly—it’s the harbinger of a debt spiral where borrowing to pay interest fuels even more debt. While fears of outright default dominate headlines, the real mechanism at play is far more insidious: soft default through financial repression. This article delves into the mechanics of this “gentleman’s trap,” exploring how inflation and manipulated interest rates are eroding purchasing power without triggering alarms. Drawing from economic history and current fiscal dynamics, we’ll unpack the tools of financial repression, the Cantillon effect’s role in widening inequality, and practical strategies for navigating this era of monetary dilution.

America’s debt burden has reached a point where the cost of servicing it is crowding out essential expenditures. In 2025, net interest outlays hit $970 billion, exceeding the $850 billion allocated to defense and even surpassing Medicaid spending. This inversion signals a fundamental imbalance: more taxpayer dollars are flowing to bondholders from past borrowings than to safeguarding the nation or supporting healthcare for the vulnerable.

To grasp the severity, consider the arithmetic. With debt at $38.4 trillion and average interest rates around 3-4%, annual interest alone approaches $1 trillion. This creates a vicious cycle—new bonds must be issued to cover old interest, inflating the principal further. Unlike a household that might cut discretionary spending, governments face rigid obligations. Social Security, Medicare, and military commitments are politically untouchable, tied to promises to aging populations and global alliances. Slashing them risks electoral backlash or strategic vulnerabilities.

This rigidity leaves traditional debt resolutions off the table. Austerity through tax hikes or deep cuts? Politically suicidal in a stimulus-dependent economy. Outright default? Catastrophic for a reserve currency like the dollar, potentially unraveling global banking and trade. Instead, the path of least resistance is financial repression—a stealthy transfer of wealth from savers to debtors via controlled rates and inflation.

| Fiscal Year 2025 Key Expenditures | Amount ($ Billion) | Percentage of Total Budget |

|---|---|---|

| Net Interest Payments | 970 | 15% |

| National Defense | 850 | 13% |

| Medicaid | 900 | 14% |

| Social Security | 1,400 | 22% |

| Medicare | 1,100 | 17% |

This table highlights how interest has become the budget’s silent predator, squeezing room for growth-oriented investments like infrastructure.

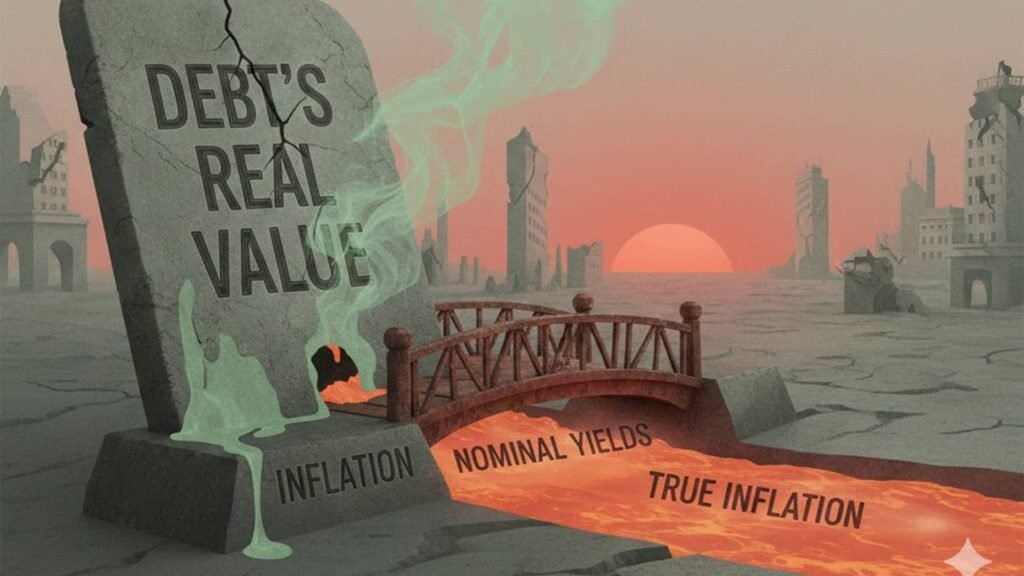

Financial repression isn’t a conspiracy—it’s a historical playbook used by empires from ancient Rome to Weimar Germany when debts overwhelm. At its core, it’s about engineering negative real interest rates: nominal yields below true inflation, gradually melting away debt’s real value. The U.S. government repays bonds in full, but the dollars returned buy far less than when borrowed.

This “soft default” operates through a trio of interconnected tools, orchestrated by the Treasury and a now-subservient Federal Reserve. First, regulatory capture turns financial institutions into captive buyers. Banks, insurers, and pension funds are mandated to hold high-quality liquid assets (HQLAs), with U.S. Treasuries defined as the gold standard. Non-compliance risks license revocation or capital shortfalls. This creates artificial demand, keeping yields artificially low despite fiscal risks—essentially forcing savers’ money into underperforming bonds.

Second, inflation metrics like the CPI are subtly massaged to understate reality. Adjustments for “substitution effects” (e.g., swapping steak for burgers when prices rise) and “hedonic quality” (discounting price hikes for product improvements) paint a rosier picture. Official inflation might hover at 3-4%, but everyday costs—housing, insurance, groceries—often surge 8-10%. This gap is an invisible tax, eroding savers’ returns while allowing the government to borrow cheaply.

Third, when demand wanes, the Fed steps in with quantitative easing (QE) or yield curve control, printing money to buy Treasuries directly. This isn’t neutral stimulus; it distorts markets, inflating asset bubbles while diluting currency value. The result? Debt doesn’t vanish—it transmutes into higher prices and diminished living standards.

In this fiscal-dominant regime, the Fed’s independence is illusory. Past chairs like Volcker could hike rates to 20% to crush inflation, even at recession’s cost. Today, with debt so massive, rates above 6-7% would balloon interest to $2 trillion annually, risking shutdowns. The central bank has morphed into the Treasury’s enabler, prioritizing debt sustainability over price stability.

Money creation isn’t a helicopter drop—it’s a targeted injection, and proximity to the source determines winners and losers. Named after 18th-century economist Richard Cantillon, this effect explains why inflation disproportionately benefits the elite.

When the Fed unleashes QE, fresh dollars flow first to Wall Street banks and institutions. They deploy this cheap capital into stocks, real estate, and buybacks before prices adjust. Assets soar: equities hit records, prime properties get snapped up. By the time money trickles to Main Street via wages or loans, inflation has already lifted costs—rents double, fuel spikes, essentials climb. Wage gains lag, leaving workers chasing a receding horizon.

This dynamic birthed the K-shaped economy, a polarized recovery with no middle ground. The upward arm: asset owners ride bubbles, their wealth compounding. The downward arm: salary-dependent households see purchasing power evaporate, savings gnawed by negative rates. Middle-class staples like 60/40 portfolios (stocks and bonds) falter in this environment—2022’s dual crash in equities and fixed income proved bonds no longer hedge against volatility when inflation reigns.

The upshot is a society where speculation replaces saving. To preserve wealth, individuals must chase yields in volatile assets, amplifying systemic risk. This isn’t prosperity; it’s illusionary growth masking structural decay.

Facing this reality, blind faith in cash or bonds is folly. The “American Dream” of compounding savings has yielded to an age where holding currency invites erosion. Yet, opportunities exist for those attuned to the signals.

Monitor these red flags to gauge repression’s intensity:

To counter, pivot to scarcity: gold and Bitcoin as inflation hedges, prime real estate for tangible value, and equities in pricing-power firms (e.g., those passing on cost increases). Ditch outdated 60/40 models; embrace diversified hard assets.

Ultimately, awareness is armor. Governments won’t default overtly, but they’ll dilute relentlessly. By understanding these dynamics, you can position yourself not as victim, but as navigator in a turbulent financial sea. As history shows, when soft measures falter, harsher tools like central bank digital currencies (CBDCs) loom—potentially enabling direct negative rates or expiration dates on money. Stay vigilant; the game favors the informed.