Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

If you’ve ever wondered why some investors seem to pull ahead while others lag behind despite similar market conditions, the answer often boils down to something deceptively simple: fund fees. Specifically, expense ratios—the annual costs baked into mutual funds and ETFs—can quietly erode your gains over time. This isn’t just theory; it’s a practical reality backed by decades of market data. In this guide, we’ll break down exactly how these fees work, their real-world effects on returns, and what you can do to keep more of your money working for you.

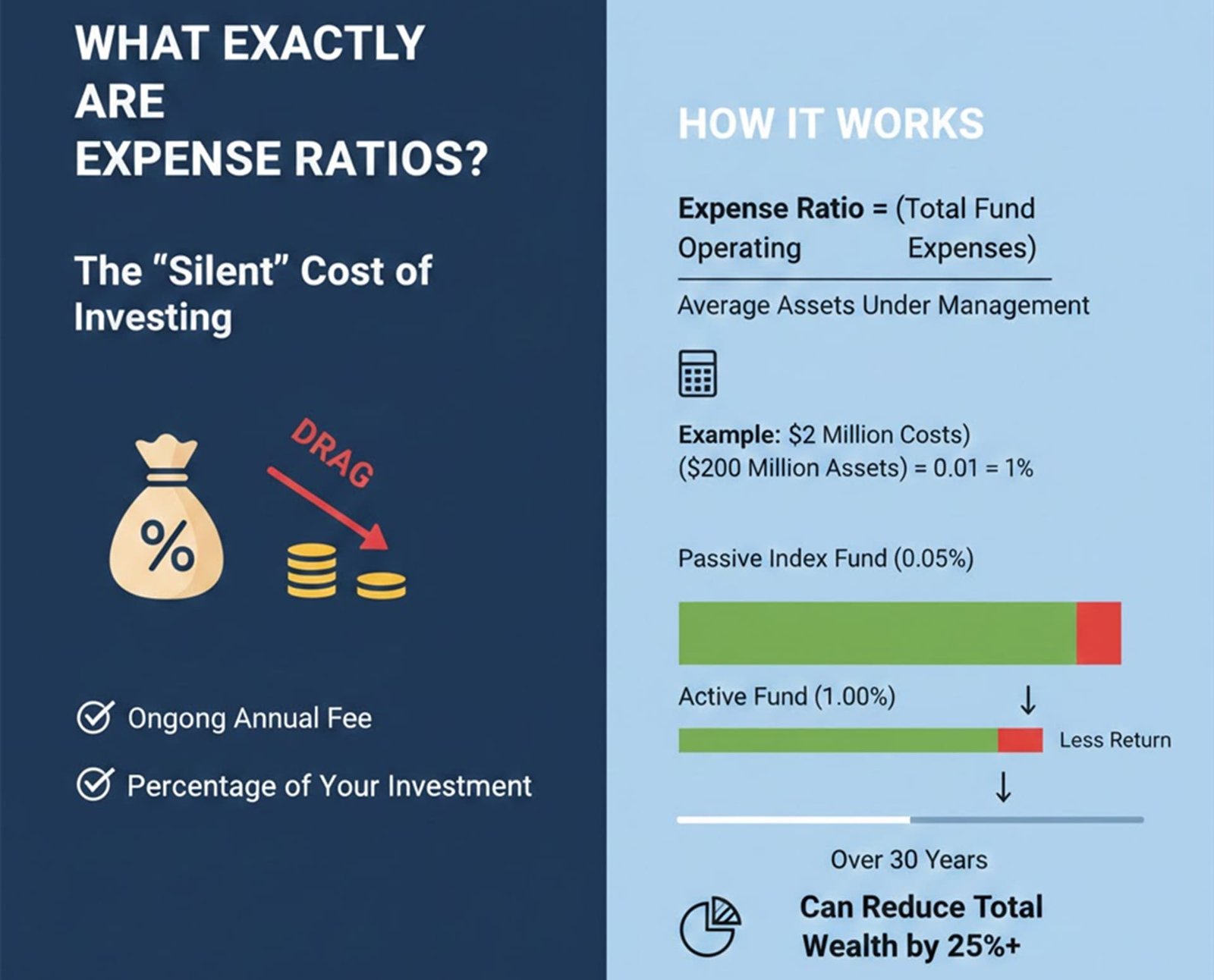

At their core, expense ratios represent the yearly price tag for running a fund. Think of them as the operating costs passed on to you, the investor, covering everything from portfolio management and administrative overhead to marketing and legal fees. They’re expressed as a percentage of the fund’s average net assets—say, 0.5% means you’re paying $50 annually for every $10,000 invested. These aren’t one-off charges; they’re deducted automatically from the fund’s returns, often daily, so you might not even notice them on your statements.

Unlike trading commissions or sales loads, which hit you upfront or at specific times, expense ratios are ongoing. They’re calculated by dividing the fund’s total operating expenses by its average assets under management. For instance, if a fund racks up $2 million in costs while managing $200 million in assets, the ratio clocks in at 1%. Actively managed funds, where experts pick stocks aiming to beat the market, tend to have higher ratios—often 0.5% to 1.5% or more—due to research and trading activity. Passive index funds or ETFs, which simply track benchmarks like the S&P 500, keep things leaner, frequently under 0.1%.

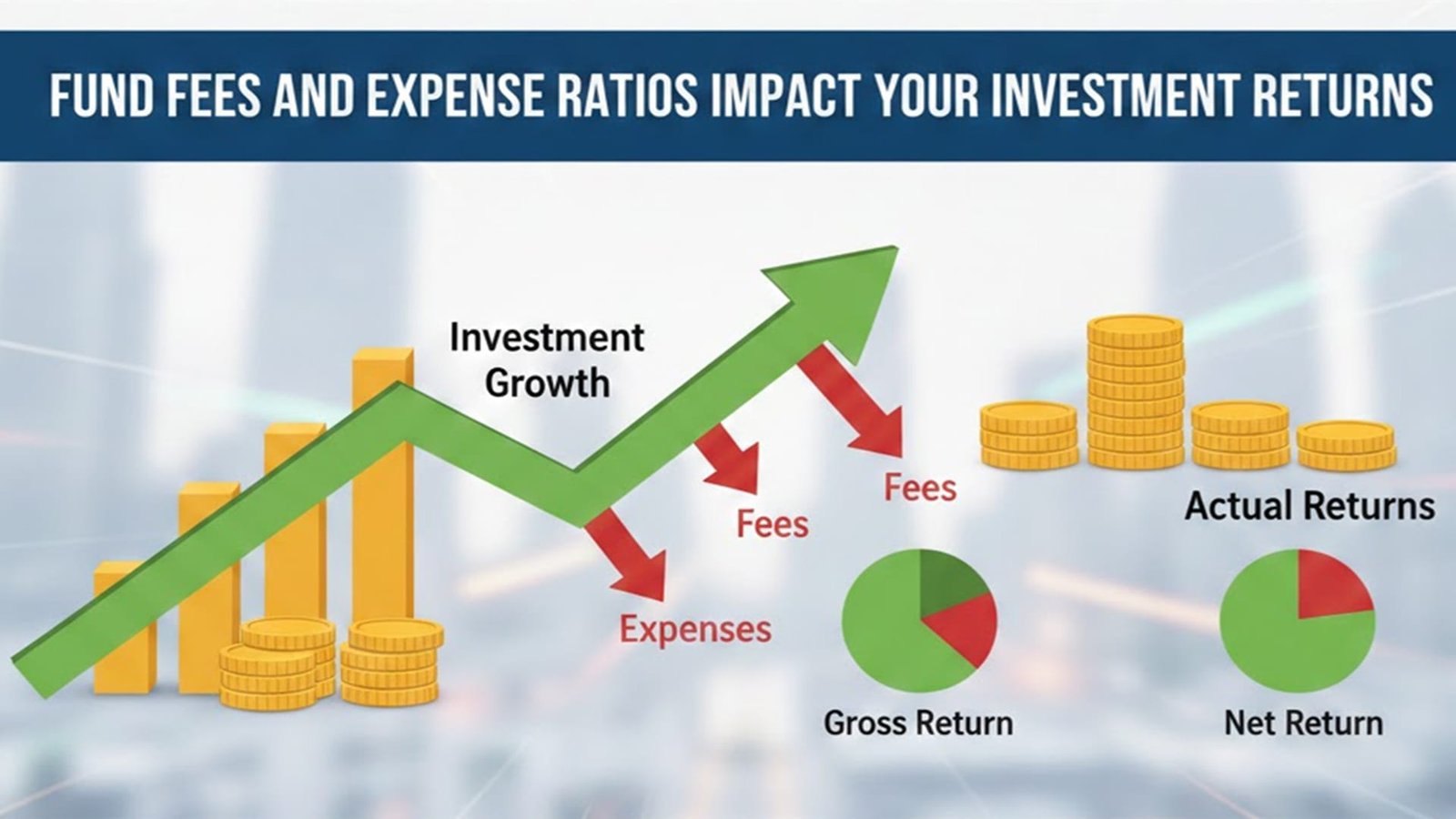

Expense ratios don’t just nibble at the edges—they directly subtract from your net performance. If a fund earns 8% gross returns in a year but carries a 1% expense ratio, you’re left with just 7% in your pocket. It sounds minor, but remember: these deductions happen regardless of how the fund performs. In down years, high fees can even turn modest losses into deeper ones, amplifying the pain.

Beyond the immediate hit, there’s opportunity cost. Every dollar siphoned off in fees is a dollar that isn’t compounding for you. Government regulators highlight this in investor alerts, noting that fees reduce not only your current balance but also the future growth on that amount. For example, on a $100,000 portfolio growing at 4% annually, a 1% ongoing fee over 20 years could shave off tens of thousands in potential value, as shown in detailed breakdowns from the SEC.

Here’s where things get eye-opening—the power of compounding works against you with fees. What starts as a tiny percentage can snowball into massive shortfalls over decades, especially in retirement accounts where time is your biggest ally. Studies show that even a 0.5% difference in expense ratios can translate to 10-20% less in your nest egg after 30 years.

Consider this: Fees compound just like returns do, but in reverse. A higher ratio means less money stays invested to grow, creating a widening gap. Industry analyses reveal that average expense ratios for stock mutual funds have dropped from around 1% two decades ago to about 0.4% today, thanks to competition from low-cost ETFs. Yet many investors still end up in pricier options through workplace plans or advisor recommendations, unknowingly forfeiting gains.

To make this concrete, let’s look at a straightforward scenario. Suppose you invest $10,000 in a fund with a consistent 6% gross annual return over 30 years—a reasonable long-term average for a balanced stock portfolio. The table below shows how varying expense ratios affect your final balance and the approximate total fees paid (calculated as the difference from a no-fee scenario). These figures assume fees are deducted from returns annually, highlighting the drag.

| Expense Ratio (%) | Final Value ($$ ) | Approx. Total Fees Paid ( $$) |

|---|---|---|

| 0.1 | 55,831.40 | 1,603.48 |

| 0.3 | 52,753.30 | 4,681.61 |

| 0.5 | 49,839.50 | 7,595.40 |

| 0.75 | 46,415.50 | 11,019.40 |

| 1.0 | 43,219.40 | 14,215.50 |

| 1.5 | 37,453.20 | 19,981.70 |

As you can see, jumping from a 0.1% ratio (common in top index ETFs) to 1% (typical for some active funds) slashes your ending balance by over $12,000—nearly 22% less wealth. And that’s conservative; real fees also include lost compounding on those deductions. Data from retirement-focused research echoes this, with one analysis showing a 0.75% ratio fund yielding 19% fewer net earnings than a 0.15% alternative on the same initial sum.

The fee-return dynamic plays out starkly when comparing fund styles. Active management, with its hands-on approach, justifies higher expense ratios through promises of outperformance. But evidence suggests most active funds fail to beat their benchmarks after fees, leaving investors worse off. Passive funds, by contrast, aim to match the market at rock-bottom costs—think Vanguard’s S&P 500 ETF at 0.03% or Fidelity’s zero-fee index options.

Specialty funds, like those targeting emerging markets or sectors, often carry steeper ratios (0.7% or higher) due to added complexity. Bond funds trend lower, around 0.03% to 0.75%, but the principle holds: lower fees correlate with better long-term outcomes in most cases. If you’re in a 401(k), scrutinize your options—many plans include high-fee choices that could be swapped for cheaper equivalents.

Minimizing expense ratios isn’t about skimping; it’s about smart allocation. Start by shopping around: Use broker tools to filter for low-cost funds in your category. Favor ETFs over mutual funds for their generally lower ratios and tax efficiency. In retirement plans, push for index options if available— they’ve driven down averages industry-wide.

Avoid extras like 12b-1 marketing fees or sales loads, which add unnecessary layers. Regularly review your portfolio; ratios can change, and switching to a lower-fee fund might be worthwhile if the math pencils out. Finally, consider total costs, including trading expenses, as some “low-ratio” funds hide turnover costs that eat into returns.

In the end, fund fees and expense ratios aren’t just line items—they’re direct barriers to your financial goals. By opting for cost-efficient investments, you’re essentially giving yourself a raise in future returns. Whether you’re starting out or fine-tuning a mature portfolio, prioritizing low fees can mean the difference between a comfortable retirement and one that’s stretched thin. Take a close look at your holdings today; the savings could be substantial. If you’re unsure, consult a fee-only advisor to map out a plan tailored to your situation.