Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Navigating the world of investments can feel overwhelming, especially when deciding between exchange-traded funds (ETFs) and mutual funds. Both are popular vehicles for building diversified portfolios, but their nuances can significantly impact your returns, taxes, and overall strategy. If you’re Googling “ETF vs mutual fund differences” or weighing the pros and cons, this guide cuts through the jargon with real-world insights drawn from industry leaders like Vanguard and Fidelity. By the end, you’ll have the tools to decide which fits your needs—whether you’re a beginner dipping into index investing or a seasoned trader seeking efficiency.

At their core, both ETFs and mutual funds pool money from multiple investors to buy a basket of securities, such as stocks, bonds, or commodities. This setup provides instant diversification, reducing the risk of putting all your eggs in one basket. Think of them as ready-made portfolios managed by professionals, saving you the hassle of picking individual assets.

Mutual funds have been around since the 1920s, operating like a collective investment scheme where shares are bought and sold directly from the fund company at the end-of-day net asset value (NAV). ETFs, a newer invention from the 1990s, trade on stock exchanges just like individual shares, allowing for real-time buying and selling. This fundamental structure sets the stage for their key differences, which we’ll explore next.

Understanding the ETF vs mutual fund debate starts with breaking down their operational mechanics. From trading flexibility to cost structures, these distinctions aren’t just technical—they directly affect your bottom line.

First off, trading mechanics: ETFs offer intraday liquidity, meaning you can buy or sell them anytime the market is open, much like trading Apple or Tesla stock. Mutual funds, however, only process transactions once per day after the market closes, based on that day’s NAV. This makes ETFs ideal for active traders who want to react to market news, while mutual funds suit long-term holders who aren’t timing the market.

On management style, most ETFs are passively managed, tracking an index like the S&P 500 with minimal intervention. This keeps things simple and cheap. Mutual funds often lean active, where managers pick stocks to beat the market, though passive options exist too. Active management can lead to higher potential returns but also greater risks and fees.

Taxes play a big role too. ETFs are generally more tax-efficient due to their “in-kind” creation and redemption process, which minimizes capital gains distributions. Mutual funds, especially active ones, might trigger taxable events more frequently when the manager sells holdings. In my experience reviewing client tax returns, this efficiency has saved ETF investors hundreds in unnecessary taxes over time.

Minimum investments vary as well. Many mutual funds require a starting amount of $1,000 to $3,000, whereas you can snag an ETF share for as little as $50, depending on the price. This lowers the barrier for smaller investors.

Finally, transparency: ETFs disclose holdings daily, giving you full visibility. Mutual funds typically report quarterly, which might feel less reassuring if you like staying in the loop.

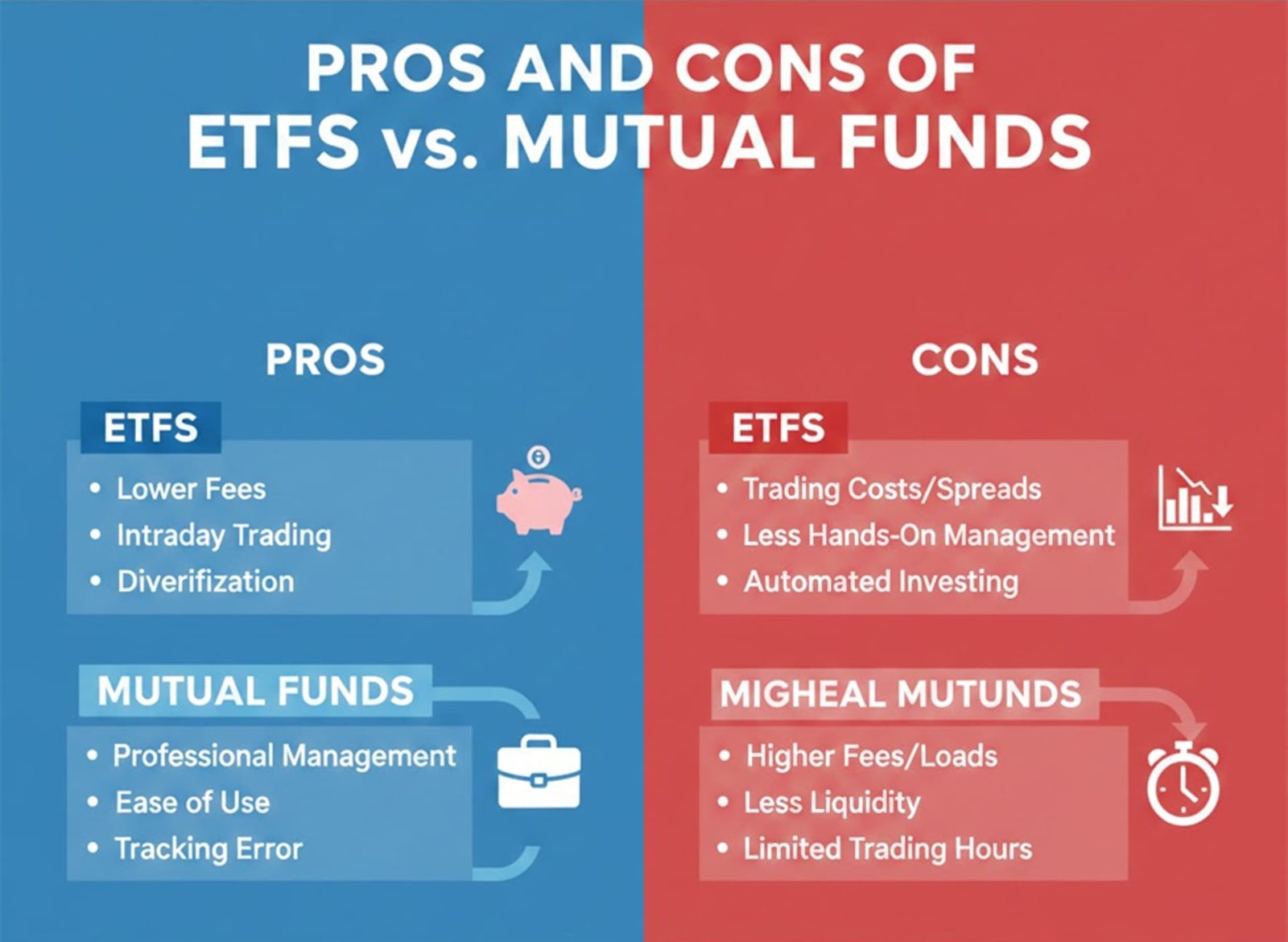

To make the ETF vs mutual fund pros and cons crystal clear, let’s weigh them side by side. Based on data from sources like Charles Schwab and NerdWallet, ETFs have surged in popularity—assets under management hit $12 trillion in 2025, up from $7 trillion in 2020—largely due to their edge in costs and flexibility. But mutual funds still hold their ground for certain strategies.

ETFs shine in low fees (average expense ratio around 0.15% vs. 0.50% for mutual funds) and no sales loads, making them cost-effective for buy-and-hold folks. Their liquidity allows for strategies like options trading or hedging, which isn’t feasible with mutual funds. On the downside, ETFs can trade at premiums or discounts to NAV in volatile markets, and brokerage commissions (though rare now) could add up for frequent traders.

Mutual funds offer potential outperformance through skilled active management—think funds that beat benchmarks during downturns. They also automate investments via dollar-cost averaging without worrying about share prices. Cons include higher fees, possible front- or back-end loads, and those pesky capital gains taxes that can erode returns.

For a quick visual aid in your decision-making, here’s a side-by-side comparison based on 2025-2026 industry averages from Vanguard and Fidelity reports. This table highlights the core factors to consider when evaluating ETFs vs mutual funds.

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Intraday on exchanges like stocks | End-of-day at NAV |

| Expense Ratios | Lower (avg. 0.15%) | Higher (avg. 0.50%) |

| Tax Efficiency | High (in-kind redemptions) | Lower (more capital gains distributions) |

| Minimum Investment | As low as one share (~$50+) | Often $1,000-$3,000 |

| Management Style | Mostly passive/index-tracking | Often active/stock-picking |

| Transparency | Daily holdings disclosure | Quarterly reports |

| Liquidity | High, with bid-ask spreads | Limited to daily trades |

| Best For | Active traders, cost-conscious investors | Long-term holders, active strategies |

These figures are approximations; always check specific funds via tools like Morningstar for the latest.

The right choice in the ETF vs mutual fund showdown boils down to your investing style, goals, and timeline. If you’re building a passive portfolio for retirement—say, via a 401(k) or IRA—ETFs often win for their rock-bottom costs and tax perks. For instance, a broad-market ETF like VTI could mirror the U.S. stock market at a fraction of the fee of an equivalent mutual fund.

On the flip side, if you believe in beating the market and are okay with higher expenses, a well-managed mutual fund might deliver alpha. I’ve recommended them to clients in niche areas like emerging markets, where active picks can navigate volatility better.

Consider hybrids too: Some firms offer mutual fund versions of popular ETFs for seamless switching. Factor in your platform—tax-advantaged accounts minimize ETF tax edges—and run the numbers. Use calculators from sites like Schwab to simulate long-term growth; a 0.35% fee difference could mean $50,000 more over 30 years on a $100,000 investment.

In 2026, with markets volatile from AI booms and rate shifts, lean toward ETFs for agility. But diversify: A mix of both can hedge your bets.

Ultimately, the differences between ETFs and mutual funds aren’t about one being “better”—it’s about alignment with your financial blueprint. From my years counseling families on wealth preservation, I’ve learned that starting small with low-cost ETFs builds confidence, while mutual funds add that human touch for complex needs. Whichever you pick, focus on long-term consistency over short-term hype. Consult a fiduciary advisor to tailor this to your situation, and remember: The best investment is one you understand and stick with. Ready to dive in? Check fund prospectuses and start with a demo account to test the waters.