Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

In the closing days of 2025, the tech world is witnessing an unprecedented frenzy that’s reshaping economies, power grids, and even geopolitical landscapes. At the heart of it all is the pursuit of Artificial General Intelligence (AGI)—machines that can think, learn, and innovate like humans, potentially unlocking trillions in value or triggering catastrophic risks. From Elon Musk’s eye-popping $1 trillion compensation package at Tesla to Sam Altman’s audacious $7 trillion chip network vision at OpenAI, the stakes have never been higher. As an analyst who’s tracked tech booms since the dot-com era, I’ve seen hype cycles come and go, but this one feels different: it’s fueled by mountains of cash, historical monetary policies, and a winner-takes-all mentality. In this deep dive, we’ll unpack the drivers, the players, the numbers, and what it all means for investors navigating this volatile terrain.

It all kicked off in earnest with Tesla’s shareholder meeting on November 6, 2025, where investors overwhelmingly approved a compensation plan that could hand Elon Musk up to $1 trillion in stock over the next decade—if he catapults the company’s market cap from around $1.5 trillion to $8.5 trillion. That’s not just ambitious; it’s a clarion call for AGI integration into autonomous driving, robotics, and energy solutions. Critics called it excessive, echoing the backlash against soccer star Christian Vieri’s record €46.5 million transfer in 1999, which was labeled an insult to the poor. Yet, here we are, six years into Musk’s era of mega-payouts, and many believe he’ll pull it off.

This isn’t isolated. NVIDIA’s market cap exploded from under $1 trillion in early 2023 to briefly touching $5 trillion in October 2025, before settling around $4.6 trillion by year-end. It took Apple 11 years from the first iPhone to hit $1 trillion, Amazon 24 years from its bookstore roots. NVIDIA? From $1 trillion to $3 trillion in months, then to $4 trillion by mid-2025. From this vantage, Tesla’s targets seem plausible, and OpenAI’s Sam Altman is pitching a $7 trillion global chip ecosystem, with SoftBank’s Masayoshi Son committing $100 billion via Vision Fund. The consensus? AGI isn’t sci-fi—it’s imminent, and the key to it is scaling compute, data, and models, no matter the burn rate.

To grasp why tech giants are splashing cash like this, rewind to 2008. The financial crisis prompted the Federal Reserve, under Ben Bernanke (nicknamed “Helicopter Ben” for his aggressive money-printing), to unleash $8 trillion in quantitative easing. Globally, central banks injected $21 trillion, ostensibly to aid the real economy. Instead, much flowed into assets, inflating stocks and enriching the top 1%, who captured half of new wealth from 2008 to 2021 per Credit Suisse reports.

Fast-forward to the zero-interest-rate era, and inflation spikes in 2021-2022 eroded cash value—U.S. rates hit 19% peaks, shrinking a $100 billion hoard to $91 billion in buying power annually. Companies had to deploy capital or watch it vanish. Options? Acquisitions (Microsoft’s $68.7 billion Activision Blizzard deal), buybacks (over $250 billion from Apple, Alphabet, Meta, and Microsoft in 2022), or speculative bets like Meta’s $50 billion metaverse flop, which tanked its stock 70%. NFTs? A $17.1 billion peak in 2022 cratered to under $500 million a year later. Even after these burns, reserves swelled: By late 2025, Alphabet held $113.8 billion, Microsoft $99.8 billion, Amazon $54.1 billion, and Meta $41.07 billion—over $300 billion combined.

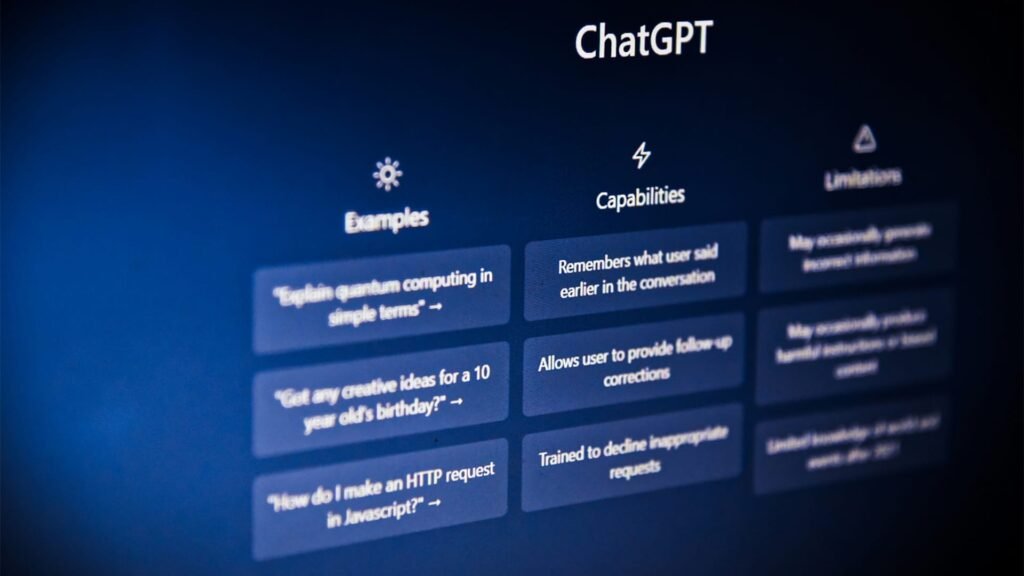

ChatGPT’s November 2022 launch changed everything, rocketing to 100 million users in two months—faster than TikTok or Instagram. It evoked Nokia’s 2007 dominance (40% market share) crumbling post-iPhone. Google founders Larry Page and Sergey Brin rejoined AI strategy sessions; Meta pivoted from metaverse woes; Amazon ensured AGI blooms on AWS. Microsoft’s Satya Nadella, with $30 billion in OpenAI, boasted of making Google “dance.” The race was on: AGI as the ultimate disruptor.

By 2025, AI capex shattered records, topping $200 billion in 2024 and projected at $500 billion for 2025. That’s equivalent to the combined defense budgets of the UK, Germany, France, and Russia—or Greece’s annual GDP. Here’s a breakdown of the big spenders:

| Company | 2025 AI Capex Projection | Key Focus Areas | Cash Reserves (End-2025 Est.) |

|---|---|---|---|

| Amazon | $125 billion | AWS data centers, nuclear power deals | $54.1 billion |

| Microsoft | $80-91 billion | Azure AI infrastructure, OpenAI ties | $99.8 billion |

| Meta | $70-72 billion | Llama models, social AI integration | $41.07 billion |

| Alphabet (Google) | $91-93 billion | Gemini AI, DeepMind advancements | $113.8 billion |

| Total Big Four | ~$366-381 billion | AGI scaling, compute dominance | ~$308.77 billion |

Data sourced from earnings reports and analyst projections. This table highlights the shift: These firms’ combined market caps exceed Japan’s GDP, ranking third globally after the U.S. and China if treated as a nation.

The AGI push demands infrastructure on steroids. Global data centers hit 1,022 operational and 504 under construction by Q3 2025, guzzling 4% of U.S. electricity—doubling by 2030. Power needs are measured in gigawatts (GW), akin to small countries: A 1 GW center costs $8-12 billion, excluding GPUs. Amazon’s AWS chief declared they’re now an “energy company,” snapping up sites near nuclear plants. Microsoft and Google follow, investing in modular reactors amid supply crunches.

Geopolitically, it’s messy. Germany and Japan’s nuclear phase-outs hike energy costs, while India’s blackouts hinder data center viability. In Virginia, farmers sell land to Google and Amazon at 10x premiums for cheap power— one noted his lifetime corn earnings couldn’t match a center’s annual electric bill. This reallocates talent too, starving basic sciences as AI vacuums top minds.

Experts are split. Benefits? AGI could spark productivity booms, solving climate woes or curing diseases, ushering in abundance. Surveys peg AGI arrival around 2040, but some say 2025-2030. Risks? Misaligned AGI could replace humanity, per DeepMind warnings of “incidents consequential enough to significantly harm society.” It’s a prisoner’s dilemma: Race ahead or risk obsolescence, but unchecked scaling invites bubbles echoing 2008’s $8 trillion wealth wipeout. IMF’s Pierre-Olivier Gourinchas likens it to the 1990s internet boom—bust possible, but not systemic.

For investors: Diversify beyond FAANG; eye AI enablers like TSMC or energy firms. If AGI succeeds, early bets pay off massively; if it flops, expect idle “digital pyramids” and market corrections.

As 2025 wraps, this gold rush—echoing James Watt’s 1776 steam engine pitch of selling “what all the world desires: power”—is humanity’s biggest bet. For ordinary folks, the best outcome is material abundance; the worst, concentrated power in unchecked monopolies. Investors, weigh the hype: Monitor capex returns, energy policies, and regulatory shifts. Society? Demand governance to align AGI with human values.

This isn’t just tech—it’s our collective future. Stay informed, invest wisely, and brace for impact.