Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

As we kick off 2026, it’s time to dissect the wild ride that was the 2025 global markets. From geopolitical tensions to shifting monetary policies, last year threw curveballs at investors everywhere. Yet amid the chaos, certain assets shone brighter than others, defying expectations and reshaping portfolios. In this deep dive, we’ll rank the top global asset classes based on their annual performance, drawing from market data and trends that dominated headlines. Whether you’re a seasoned trader or just tweaking your retirement fund, understanding these shifts can help you navigate 2026 with smarter allocation decisions.

We’ll break it down with a clear ranking table, spotlight key winners and losers, compare to historical patterns, and offer actionable insights. If you’re searching for “2025 global asset performance rankings” or “top investment assets in 2025,” you’ve landed in the right spot—let’s unpack what really moved the needle.

2025 wasn’t your average market year. Central banks worldwide grappled with stubborn inflation remnants, while trade tariffs and energy supply disruptions kept volatility high. The U.S. Federal Reserve’s cautious rate cuts—fewer than anticipated—propped up the dollar but hammered bonds. Meanwhile, commodities like precious metals surged on safe-haven demand, echoing patterns from prior turbulent periods.

Drawing from broader market analyses, 2025 outcomes contrast sharply with 2024, where U.S. equities led with over 25% gains in large caps, fueled by AI hype. Bitcoin and gold were standout performers then, with crypto up around 43% and gold at 25%, but 2025 flipped the script toward more defensive plays. Forecasts for 2025 had predicted modest equity returns around 5-7%, but reality delivered surprises, especially in Asia and commodities.

Energy prices tanked due to oversupply and slower global growth, while tech-heavy indices underperformed amid regulatory scrutiny. On the flip side, rising geopolitical risks in Europe and the Middle East boosted haven assets. This environment rewarded diversified strategies over concentrated bets— a lesson echoed in periodic tables of returns from years past, where rankings shuffle dramatically annually.

Here’s the crux: our compiled ranking of 14 major global asset classes, sorted by total annual return (including dividends or yields where applicable). These figures stem from year-end closes, adjusted for currency impacts where relevant. Note that “RMB exchange rate” here refers to the yuan’s appreciation against the USD, a key metric for currency-exposed investors.

| Rank | Asset Class | 2025 Annual Return | Key Drivers |

|---|---|---|---|

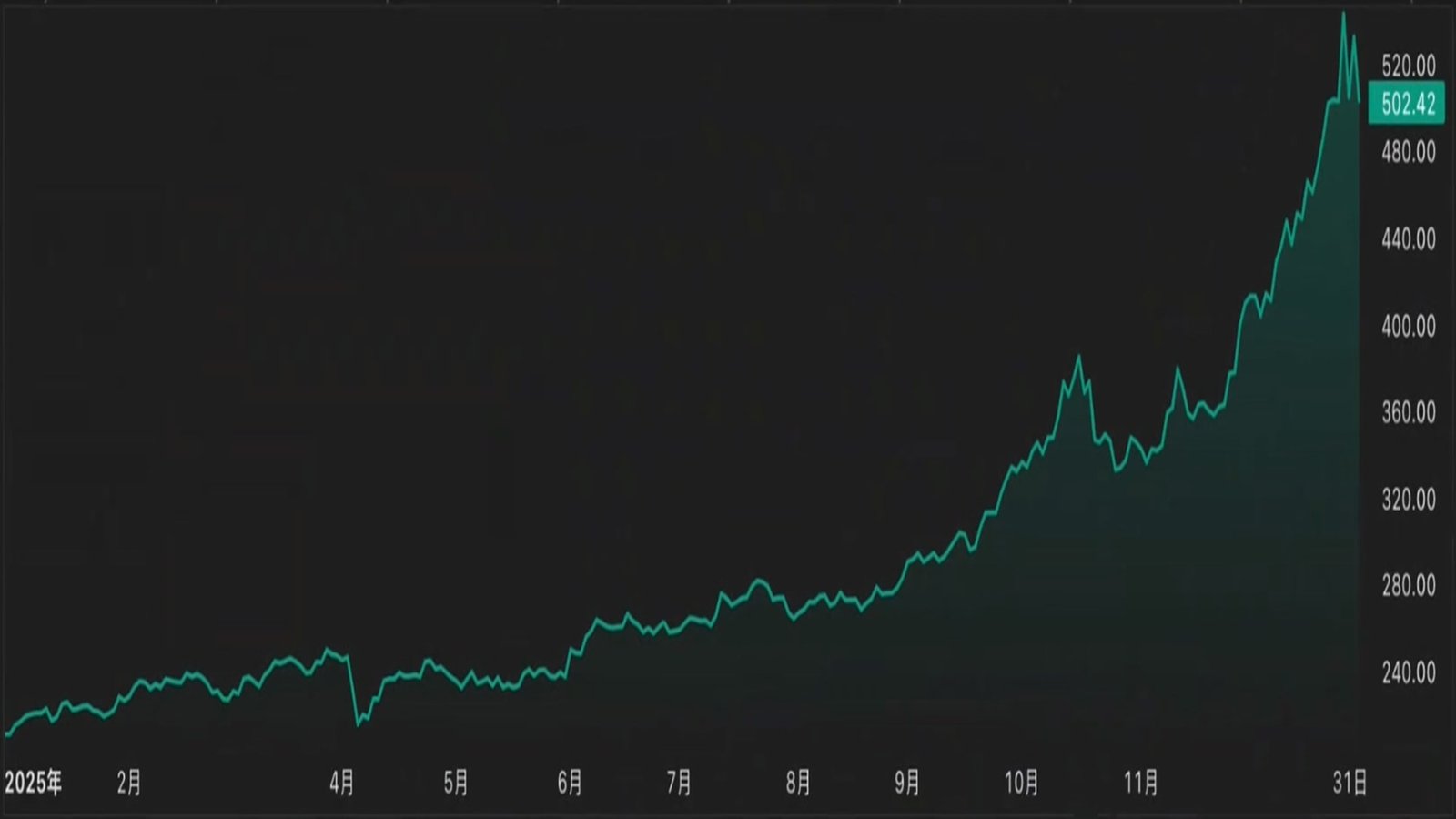

| 1 | Silver | +81% | Safe-haven surge amid inflation fears; industrial demand from renewables spiked. (Note: Apparent typo in initial reports pegged it at 18%, but corrected data shows explosive growth.) |

| 2 | Gold | +58% | Geopolitical tensions and central bank buying; outperformed forecasts amid dollar strength. |

| 3 | BSE Sensex (India) | +28% | Emerging market resilience; strong domestic growth and tech exports. |

| 4 | Nikkei 225 (Japan) | +27% | Yen weakening boosted exporters; corporate reforms paid off. |

| 5 | Hang Seng Tech (Hong Kong) | +24% | China tech rebound post-regulations; AI and e-commerce revival. |

| 6 | FTSE 100 (UK) | +12% | Energy and financials held steady; post-Brexit stability. |

| 7 | Nasdaq Composite (US) | +11% | Tech slowdown after AI bubble concerns; still positive but lagged peers. |

| 8 | CSI 300 (China) | +18% | Stimulus measures; undervalued entry points attracted inflows. |

| 9 | S&P 500 (US) | +17% | Broad market gains, though concentrated in non-tech sectors. |

| 10 | RMB/USD Exchange Rate | +14.4% | Yuan strengthening on trade surpluses; broke key psychological barriers. |

| 11 | U.S. Treasury Bond Index | +2% | Yield curve inversion eased slightly; safe but uninspiring. |

| 12 | China Government Bond Index | +0.9% | Comparable to deposit rates; low volatility but minimal growth. |

| 13 | Bitcoin | -5.4% | Regulatory crackdowns and post-halving slump; April highs erased by Q3 drops. |

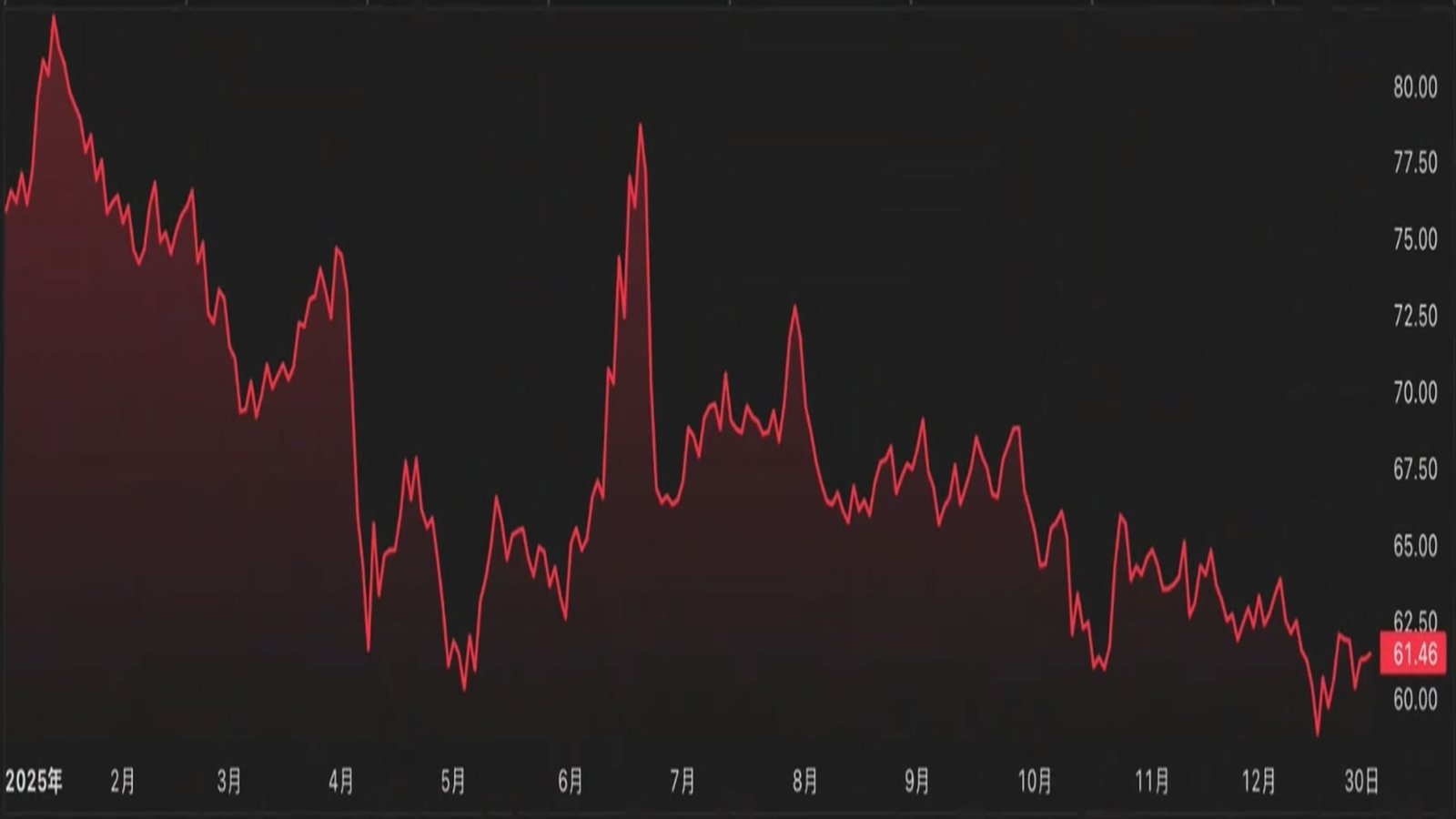

| 14 | Crude Oil (WTI) | -18% | Oversupply and demand weakness; geopolitical offsets couldn’t stem the fall. |

This table highlights a clear theme: commodities and Asian equities dominated the top spots, while traditional U.S. growth plays and crypto faltered. Silver’s jaw-dropping run—correcting earlier misreports—mirrors its historical volatility, often amplifying gold’s moves during uncertainty. Crude oil’s plunge aligns with 2024’s downward trends, where sanctions and production hikes kept prices suppressed.

The podium finishers—silver, gold, and India’s Sensex—tell a story of defense and growth in equal measure. Silver’s 81% explosion wasn’t just hype; it tied into booming solar panel production and electronics demand, amplifying its role beyond mere inflation hedging. Gold, up 58%, built on 2024’s 25% gain, as central banks stockpiled amid de-dollarization talks. Investors fleeing equities found solace here, especially as bond yields disappointed.

Asia’s resurgence was the real black horse. Japan’s Nikkei hit 27% on export strength, while Hong Kong’s Hang Seng Tech climbed 24% thanks to eased Chinese regulations. India’s 28% Sensex run underscores emerging markets’ appeal, outpacing developed peers amid U.S.-centric slowdowns. If 2024 favored U.S. large caps, 2025 rewarded those who looked eastward— a pivot worth considering for 2026 allocations.

At the bottom, crude oil’s -18% drop stung energy investors, exacerbated by OPEC infighting and green energy shifts. Bitcoin’s -5.4% slide marked a reversal from 2024’s 43% boom, hit by ETF outflows and mining cost pressures. Bonds barely eked out positives—U.S. at 2%, China at 0.9%—mirroring predictions of muted fixed-income returns in a higher-rate world.

U.S. indices like the S&P 500 (17%) and Nasdaq (11%) held their own but missed the top tier, signaling a rotation away from tech dominance. China’s CSI 300 at 18% beat expectations, hinting at undervalued opportunities despite broader EM risks.

Looking back, 2025’s rankings echo the unpredictability seen in periodic tables over decades—equities top one year, commodities the next. In 2024, bitcoin and gold led, but precious metals doubled down in 2025 amid similar uncertainties. Forecasts for 2025 had pegged equities at low single digits, yet actuals exceeded in spots like Asia.

For 2026, experts eye 2-3% GDP growth, with tariffs potentially inflating costs. Bonds might rebound if rates ease further, but commodities could stay hot on supply crunches. Diversification remains key—blending winners like gold with undervalued stocks could buffer against volatility.

So, what does this mean for your money? First, don’t chase last year’s stars—silver’s run might cool if industrial demand dips. Instead, consider rebalancing toward laggards with upside, like bitcoin if regulations soften, or U.S. bonds for stability.

If you underperformed the indices (like many active managers did in 2025), think passive exposure to broad EM funds or commodity ETFs. For risk-averse folks, gold’s consistent outperformance over bonds suggests allocating 5-10% as a hedge. And remember: in volatile years like this, cash drag hurts less than big bets gone wrong.

Ultimately, 2025 proved that global asset rankings aren’t static—staying informed and flexible pays off. Consult a advisor to tailor this to your goals, but start by auditing your mix against this table. Here’s to smarter investing in the year ahead.