Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

As of February 2026, humanity has spent millennia unearthing approximately 220,000 tons of gold. Yet, a startling paradox governs the global economy: the market price of every gram of gold on earth is dictated by a mere 566 tons sitting in a few high-security vaults in New York.

This is not a conspiracy; it is the mechanics of the “Tail Wagging the Dog.” But in 2026, for the first time in fifty years, the “Dog”—physical gold—is fighting back.

To understand gold in 2026, you must stop looking at jewelry and start looking at the New York Commodity Exchange (COMEX).

While the world holds 220,000 tons of gold, most of it is “dormant”—locked in central bank vaults, hanging from the necks of brides in Mumbai, or stored in private safes in Shanghai. Only a tiny fraction is “active.”

| Category | Amount (Approx.) | Market Role |

| Total Mined Gold | 220,000 Tons | Global Stock |

| Jewelry/Private Art | 96,000 Tons | Non-Liquid |

| Institutional Investment | 48,000 Tons | Long-term Store |

| Official Central Bank Reserves | 38,000 Tons | Strategic Anchor |

| COMEX Deliverable Inventory | ~566 Tons | The Pricing Engine |

Currently, the daily trading volume on COMEX averages $145.5 billion, while the total physical gold available for delivery in their vaults is worth only about $90 billion. Every single day, the “paper” market trades 1.6 times the total physical inventory available.

The current pricing power of the U.S. was established in 1974. Following the collapse of the Bretton Woods system, the U.S. strategy—outlined in the now-declassified Kissinger memos—was to prevent gold from becoming a “money” again by turning it into a “speculative commodity.”

By creating a massive futures market, the U.S. could suppress prices using “paper gold.” When prices rose too fast, institutional sellers could dump massive amounts of futures contracts (which require no physical gold to sell) to crash the price.

The result? Central banks, which crave stability, viewed gold as a “volatile gamble” and preferred the “safety” of U.S. Treasuries. This held for decades—until 2022.

The geopolitical seismic shift of 2022—the freezing of $300 billion in Russian reserves—changed the calculus of central banks. They realized that “digital dollars” are a liability, while “physical gold” is an asset.

Since 2022, a “Buyer’s Club” of 30 nations (including China, India, Saudi Arabia, and Poland) has been purchasing over 1,000 tons of physical gold annually.

Swiss customs data reveals that over 5,000 tons of gold have migrated through Swiss refineries to Asian vaults in the last three years. This gold is leaving the London (LBMA) and New York (COMEX) ecosystems and is being “locked away” in the East.

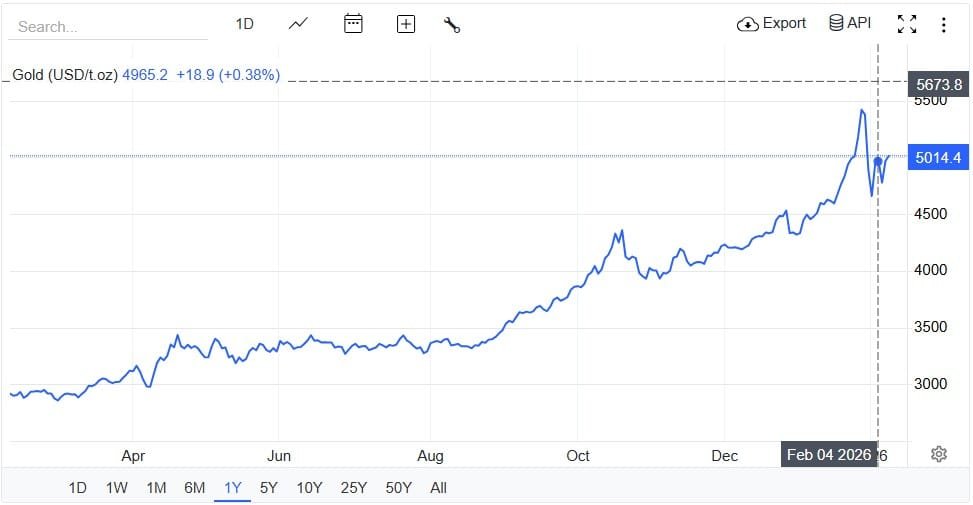

In early February 2026, gold plummeted from a record high of $5,600/oz to the $4,700 range within 48 hours. The catalyst? The nomination of Kevin Warsh (a known hawk) as Fed Chair.

The market interpreted this as a return to “Strong Dollar” policies. Wall Street algorithms dumped billions in futures in seconds. However, this crash lacks the “follow-through” of previous decades. Why? Because while the Paper Tail (New York) is swinging wildly, the Physical Dog (Central Banks) is sitting still.

Every time the price dips, “mysterious buyers” (sovereign entities) step in to provide a floor. They aren’t trying to “pump” the price; they are simply exiting the dollar system.

The most important takeaway for 2026 is that the surge in gold prices to $5,000+ is not about gold “changing.” Gold is the most stable element in human history.

What has changed is the ruler. The $38 trillion U.S. debt and the weaponization of the financial system have “shortened” the dollar. When you see gold prices jumping, you aren’t seeing gold gain value; you are seeing the currency used to measure it lose its integrity.

The 1,000 tons bought by central banks annually against the 566 tons used for pricing in New York is the most significant “slow-motion war” in financial history. The winner of this battle will define the next global reserve system.

Strategic Insight: For the individual observer, the short-term fluctuations of the COMEX price are “noise.” The “signal” is the physical migration of gold bars to sovereign vaults. Until the U.S. debt trajectory changes, the fundamental demand for an “un-printable” asset remains irreversible.