Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

The lights didn’t just flicker on Wall Street last night; they went out for an entire asset class. If you are holding tech stocks or working in the “Golden Trio” of white-collar professions—coding, law, or finance—you are no longer standing on stable ground. You are standing on a tectonic shift.

The catalyst? Anthropic’s unceremonious drop of Claudecowork.

This isn’t another “helpful chatbot” that hallucinates poetry. It is a digital executioner. By granting AI direct agency over enterprise backbones—auditing thousands of legal contracts in seconds and automating sales forecasting with terrifying precision—Anthropic has effectively declared war on the seat-based pricing model, the very foundation of the SaaS industry.

But while the headlines scream about the $285 billion evaporation in software market cap, the real story lies in the “Schizophrenic Gap”: the inexplicable, violent sell-off of AI’s lifeblood—Nvidia and AMD.

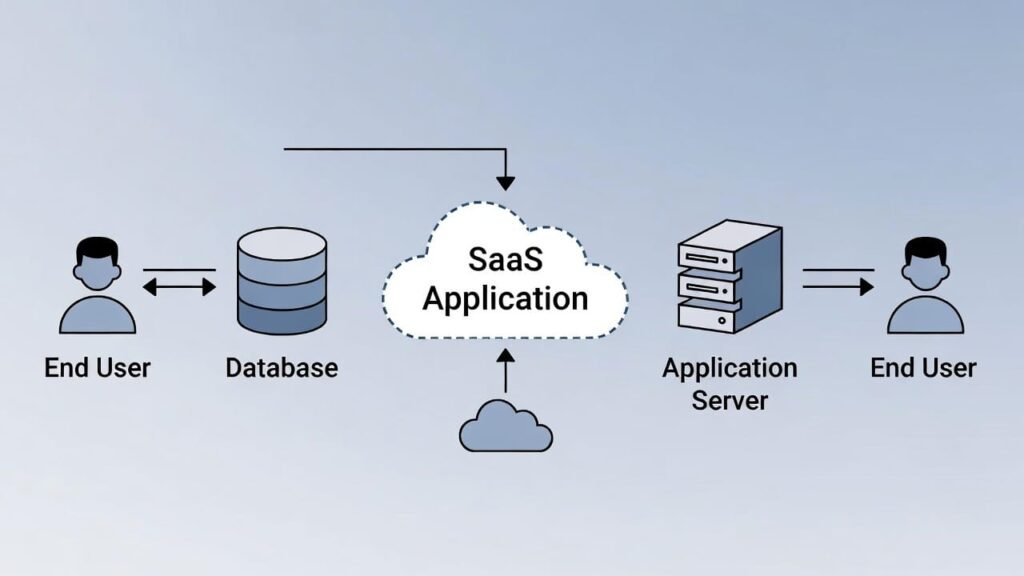

For fifteen years, the SaaS industry operated on a simple, parasitic logic: More headcount = More licenses = More revenue. Salesforce, Adobe, and Workday grew fat on this “seat-based” inertia. Claudecowork changes the math from man-hours to outcomes.

If one AI Agent can perform the work of fifty junior analysts, an enterprise doesn’t need fifty licenses; they need one “Manager” license. This isn’t efficiency; it’s an extinction event for companies that sell software by the head.

| Category | Typical Players | Survival Status | The “Fatal Flaw” or Moat |

| Digital Carriages | Basic CRM, PDF converters, Entry-level Tax/Legal tools | Terminal | They offer “features” that are now native capabilities of LLM agents. |

| SaaS Old Guard | Salesforce, Adobe, Workday | Critical / Pivot Required | Trapped in “Innovator’s Dilemma”—adopting AI kills their license revenue. |

| The New Architects | ServiceNow, Palantir | Dominant | They own the “Operating System” or private data silos AI cannot scrape. |

The most irrational part of the “SaaSpocalypse” was the 17% plunge in AMD and the four-day slide for Nvidia.

Wall Street is currently peddling two contradictory narratives that cannot coexist in a rational universe:

Think about the logic. If Narrative A is correct, the demand for compute is infinite. To replace millions of human “seats” with autonomous AI agents requires a massive, sustained expansion of GPU clusters. You cannot have a “SaaS Apocalypse” without a “Compute Renaissance.”

The reality? This isn’t a fundamental shift; it’s a liquidity event. Institutions are over-leveraged in tech. When software crashed, they sold their most liquid, “winning” assets—Nvidia and AMD—to cover margins and rebalance portfolios. It’s not a lack of faith in chips; it’s a fire sale of the family’s finest silver to save the burning house.

History tells us that during the 2000 Dot-com crash, the market didn’t distinguish between a pet-food website and Amazon. Everything died. The “Smart Money” today is looking for the “Amazons” hidden in the rubble of 2026.

Model weights are becoming a commodity. Intelligence is becoming “too cheap to meter.” In this world, the only thing that matters is Proprietary Data.

If you are staring at a sea of red, here is your cold-blooded playbook:

Is AI the guillotine for software? For the “Digital Carriages”—yes. The era of charging $100/month for a glorified interface is over.

But for those who own the underlying architecture and the private data silos, this is the greatest “Buy the Dip” opportunity since 2008. Wall Street’s current “Schizophrenia” is a gift to the rational observer. Logic may be temporarily absent from the trading floor, but the math of compute-demand remains undefeated.

The “SaaSpocalypse” isn’t the end of the world; it’s the migration of value from the interface to the engine.