Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

JPMorgan reports, back to their pre-2008 crisis calls—I’ve always appreciated their blend of macro prudence and sector-specific sharpness. Their latest 2026 outlook on Chinese assets, pieced together from various firm publications including their fixed income perspectives and global wealth management forecasts, paints a picture of moderated growth with pockets of opportunity. Drawing on JPMorgan’s data alongside insights from Bloomberg and Reuters on China’s evolving landscape, this breakdown covers their GDP projections, equity rebound scenarios, favored themes like anti-involution and AI supply chains, and the pitfalls investors should watch. If you’re reallocating for 2026, we’ll weigh how these views could shape your China exposure—whether through ETFs, direct stocks, or broader EM plays—helping you decide if it’s time to lean in or hedge out.

JPMorgan sees China’s GDP growth easing to around 4.3-4.5% in 2026, down from 2025’s estimates, but with downside risks contained thanks to proactive policy levers. This moderation stems largely from waning net export contributions, as global tariffs bite and front-loaded shipments from 2025 unwind. Yet, the firm highlights three buffers: aggressive fiscal and monetary support to underpin markets, investments in “new productive forces” like tech upgrades, and a cyclical rebound from pent-up demand.

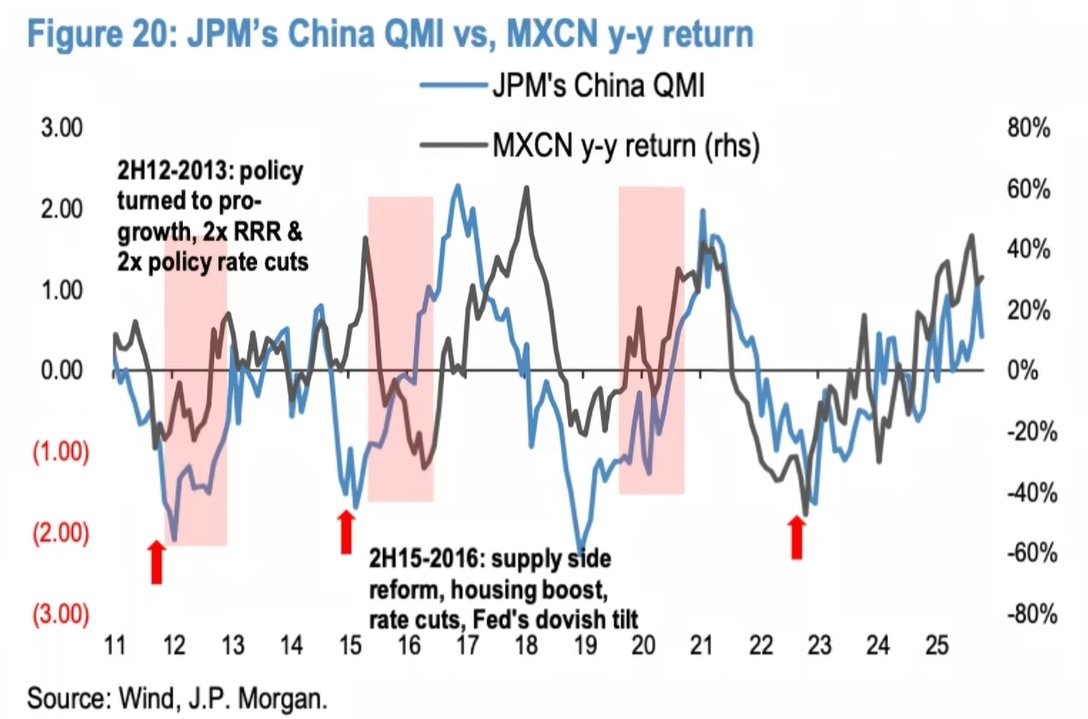

Their proprietary China Quality Momentum Index (QMI) signals early recovery, tracking closely with MSCI China—a gauge of overseas-listed Chinese firms including Hong Kong, mainland, and ADRs. Sector-wise, JPMorgan’s analysis of 36 industries shows a shift: Contraction phases (yellow zones) are fading, while expansion and recovery (orange/green) gain traction since mid-2024. This aligns with broader sentiment; Reuters notes stabilizing home prices and a tech stock surge of 34% in 2025, fueled by firms like DeepSeek challenging U.S. AI dominance. Fiscal policy remains key, with central deficits at 4% of GDP and upsized bonds (CNY1.8 trillion special CGB, CNY4.4 trillion local) targeting tech FAI over real estate bailouts.

Monetary easing adds tailwinds: Expect 10-20 bps rate cuts and possible 50 bps RRR reductions for liquidity, though no aggressive flood given deflation risks. Bloomberg echoes this, pointing to consumer sentiment lifts from housing stabilization and diversified stimulus into tourism and services.

JPMorgan frames the CSI 300—China’s blue-chip benchmark—as entering its fourth bull cycle, with prior waves delivering 90%+ rebounds from troughs. They outline three rebound tiers from 2025 lows:

This optimism ties to funding inflows: Domestic shifts from bank deposits to stocks via insurance and pensions, plus ETF surges. Globally, U.S. rate cuts and dollar volatility could redirect capital to EMs, including China. However, the firm stresses rotation: Broad indices may lag if sector wheels turn, as seen in 2025 where mega-caps dominated while laggards stagnated.

Lower rates will coax funds out of low-yield banks into equities, per JPMorgan—mirroring trends in insurance-linked investments and personal pensions. ETFs stand to benefit most, with foreign inflows accelerating as U.S. easing weakens the dollar. Their outlook notes EM equities like those in India and Taiwan (tied to AI semis) as comparables, but China’s trade surplus—ballooning despite U.S. export drops—positions it well for rerouted flows via Southeast Asia. Risks here? If U.S. tariffs escalate post-midterms or geopolitical flares, inflows could reverse.

Not all sectors get equal love; JPMorgan flags four Q1 themes, emphasizing quality over volume in a post-uniform-rally era. Each comes with targeted picks (though regulatory limits obscure names here—check firm reports for details), drawing from anti-involution shifts and global linkages.

| Theme | Key Sectors/Drivers | Potential Upside | Main Risks |

|---|---|---|---|

| Anti-Involution | Airlines, steel, solar; shift to quality competition | Higher margins from reduced price wars | Policy execution shortfalls, local gov’t resistance |

| AI Infrastructure Supply Chain | Data centers, energy storage, power equipment | 30-35% capex growth from U.S./China demand | U.S. AI slowdown, economic crises |

| China Outbound Expansion | EVs, consumer electronics, machinery, biotech | Outperformance like Japan’s overseas leaders | Geopolitical tensions, U.S. tariffs |

| K-Shaped Consumption | Premium housing/gaming, budget food/beer | Rebound in high/low ends amid polarization | Further real estate woes, broad slowdown |

JPMorgan’s cautionary notes center on execution gaps in anti-involution, U.S.-linked AI vulnerabilities, and external shocks like tariffs. Broader hazards include persistent deflation, housing drags (sales/F.AI down sharply), and export moderation amid global slowdowns. Geopolitics looms large: Over 300 anti-dumping cases against China in three years, up threefold. For investors, this means diversification—pair China bets with EM hedges like Indian consumption or Taiwanese semis.

JPMorgan’s report isn’t a blanket buy-China signal; it’s a call for selective plays in resilient themes while capping exposure to frothy rebounds (e.g., Tier 3 CSI 300). For global allocators, tilt toward quality bonds (CGB range-trading) and EM credit amid Fed easing. If overweight U.S. tech, rotate some to Chinese AI supply chains for correlation benefits. Tools like MSCI China ETFs offer entry, but stress-test against tariff scenarios—use Bloomberg terminals for simulations. Ultimately, in a K-shaped world, focus on winners in quality shifts; avoid chasing uniform rallies. For deeper reads, snag JPMorgan’s full PDF outlooks—their track record on EM rotations makes them worth the dive.

[…] JPMorgan’s 2026 China Assets Outlook Report […]