Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

As we step into 2026, China’s property market is at a pivotal juncture. After years of headwinds, from sales slumps to developer debt woes, there’s growing optimism that Beijing’s renewed policy push could finally stabilize the sector. JPMorgan’s latest insights highlight this shift, pointing to intensified support measures that might spark a recovery. But is this rally sustainable, or just another fleeting bounce? Drawing from recent economic data and expert analyses, this piece breaks down the logic behind the policy pivot, recaps 2025’s tough ride, forecasts what’s ahead for 2026, and spotlights top picks like China Resources Land and China Resources Mixc Lifestyle. If you’re eyeing exposure to Chinese real estate stocks, here’s how to navigate the opportunities—and risks—with a clear-eyed strategy.

Why the sudden urgency to ramp up real estate support? It’s no secret that the sector has been a drag on China’s economy. Property and construction account for about 13% of GDP and employ over 70 million people, with ripple effects across industries like steel, cement, and appliances. When sales tank, so does consumer spending and job security.

In 2025, the market hit new lows. Nationwide home prices fell 3.7% on average, with steeper drops in secondary markets. New home sales by top developers plunged 36-42% year-over-year in key months, and land sales revenue slumped 65% from 2020 peaks. State-owned enterprises fared better, but even they saw sales dip 9-10%, while private firms cratered 45%. This wasn’t just numbers—it fueled deflationary pressures and eroded household wealth by trillions.

Enter Beijing’s response. Late-2025 signals, including a Qiushi magazine piece emphasizing “one-time sufficient” policy dosing over piecemeal tweaks, set the tone. Officials are now prioritizing market stabilization as a pillar of growth, with urban renewal and inventory reduction front and center. Expect tailored measures: easing purchase restrictions in big cities, mortgage subsidies, tax rebates, and converting unsold homes into affordable housing. This isn’t about reigniting a bubble—demographics and oversupply limit that—but about preventing a deeper spiral.

JPMorgan echoes this, forecasting stronger support in 2026, though focused on slowing the decline rather than reversing it fully. Fiscal tools like upsized special bonds (up to CNY4.4 trillion for locals) and consumption subsidies could indirectly buoy property by lifting sentiment. The Two Sessions in March might formalize these, potentially via the 15th Five-Year Plan, emphasizing precise, city-specific adjustments.

Last year was brutal. Primary sales fell 8%, investment dropped 15%, and only 10 developers hit the 100 billion yuan sales mark—down from 43 in 2020. Tier-1 cities like Shanghai showed some resilience with minor price upticks in new builds, but secondary homes tumbled, and land deals shrank 10-14%. Inventory de-stocking slowed in the second half, with many Tier-3/4 cities facing cycles over two years.

| Key 2025 Metrics | Nationwide Change (YoY) | Notes |

|---|---|---|

| New Home Sales (Value) | -8% to -10% | Top 100 developers saw 36-42% drops in peak months |

| Home Prices | -3.7% | Sharper in Tier-2+ cities; deflationary drag |

| Property Investment | -15% | Structural issues like oversupply persist |

| Land Sales Revenue | -11.4% | 65% below 2020 peak; state buyers retreating |

Polarization deepened: state-backed firms grabbed premium land in core cities, while privates struggled with funding. Vanke’s debt restructuring highlighted ongoing risks, even for giants. Yet, amid the gloom, stocks rallied late in the year on stimulus bets, with property shares jumping 5% in early 2026 sessions.

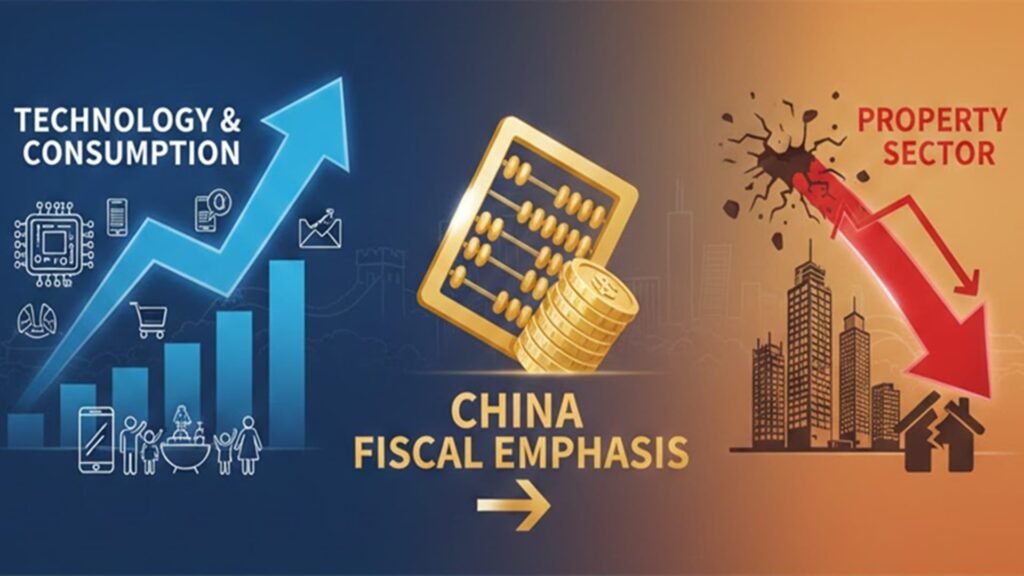

Don’t expect a V-shaped rebound—analysts like S&P and Fitch predict sales values dipping another 6-8%, with prices easing 2.8%. But policy could narrow declines, making 2026 a year of gradual steadying. GDP growth might moderate to 4.5%, with fiscal emphasis on tech and consumption over property. Urban renewal will ramp up, targeting inefficient supply and boosting affordable units.

City divides will widen: Tier-1 spots like Beijing could see premium projects hold value, while lower tiers grind through de-stocking. Demand shifts toward larger, improved homes for families. Overall, expect more activity than 2024-2025, but risks like deflation or external shocks (e.g., U.S. tariffs) loom.

JPMorgan favors names with solid fundamentals amid the uncertainty. China Resources Land (Huarun Land) stands out for its state-backed stability, prime urban land banks, and financing edge. It’s weathered the storm with steady operations in Tier-1/2 cities, where risks are lower. Analysts project modest growth, with a Hold rating and HK$32 target.

Its affiliate, China Resources Mixc Lifestyle (Huarun Wanxiang), focuses on property management and commercial ops—asset-light and resilient. Management area is expanding fast, with top-tier service quality and high collection rates. Earnings are forecast to grow 12.7% annually, with EPS up 12.8%. UBS recently upgraded to Buy with a HK$47.50 target, citing 100% dividend payouts and robust core growth.

| Stock Comparison | China Resources Land | China Resources Mixc Lifestyle |

|---|---|---|

| Current Price (HK$) | ~25-30 | 43.94 (as of Jan 2026) |

| P/E Ratio (2025) | 22.2x | 23.9x |

| Yield (2025) | 4.47% | 4.47% |

| Analyst Consensus | Hold (Upside ~7-8%) | Strong Buy (Upside +8%) |

| Key Strength | Premium land in core cities | Asset-light, high-growth management |

Both tie back to China Resources Group, offering synergy in a volatile space.

This rally is policy-fueled, so stay nimble. Recent surges—property stocks up 5% early 2026—stem from stimulus bets and weak data amplifying expectations. But if measures fall short, volatility spikes.

Focus on cash-rich, operationally sound firms with quality land reserves. Avoid blind bets on privates; stick to state-linked plays for lower risk. For short-term trades, watch Two Sessions catalysts. Long-term? Diversify into management arms like Mixc for steadier yields. Overall, Chinese equities could extend gains into 2026, with 9-15% profit growth, but temper optimism—fundamentals must catch up.

China’s real estate won’t boom overnight, but 2026 policies could mark a turning point. JPMorgan’s bets on stable names like China Resources Land and Mixc offer a safer entry amid the noise. Weigh your risk tolerance: if you’re in for the policy wave, position early but exit if basics don’t improve. As always, consult pros and diversify— the sector’s revival hinges on execution, not just promises.