Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

As of February 2026, humanity has spent millennia unearthing approximately 220,000 tons of gold. Yet, a startling paradox governs the global economy: the market price of every gram of gold on earth is dictated by a mere 566 tons sitting…

If you thought 2025 was a wild ride for the S&P 500—fueled by relentless AI narratives and index-high euphoria—you haven’t seen anything yet. While most investors are still obsessing over NVIDIA’s next quarterly beat or the latest Large Language Model…

As of January 6, 2026, the global silver market is approaching a structural stress test unlike anything seen in modern commodity history. With less than 60 days remaining before the March COMEX silver contract delivery, open interest has surged to…

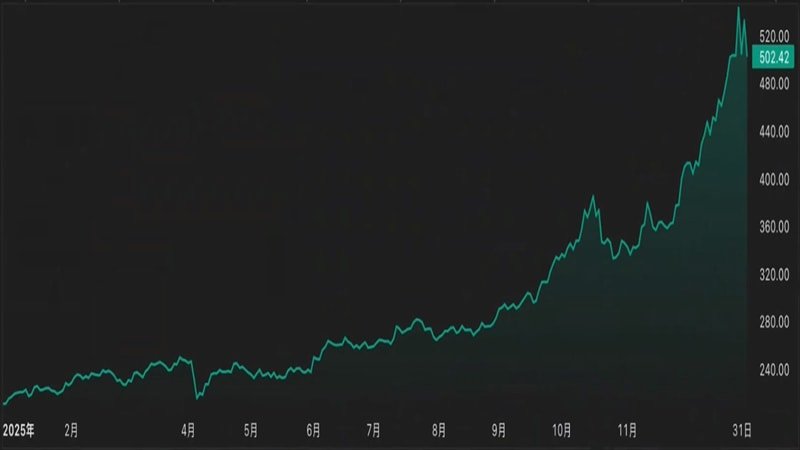

As we kick off 2026, it’s time to dissect the wild ride that was the 2025 global markets. From geopolitical tensions to shifting monetary policies, last year threw curveballs at investors everywhere. Yet amid the chaos, certain assets shone brighter…

In the fast-paced world of investing, understanding the broader market dynamics can make all the difference between spotting a genuine rally and falling for a deceptive uptick. Market breadth, often overlooked by novice traders, serves as a critical lens for…

In the ever-shifting landscape of U.S. stock markets, investors often find themselves pitting major indices against each other to gauge broader trends. The Dow Jones Industrial Average (DJIA) and the Nasdaq Composite stand out as two titans, each representing distinct…

In the fast-paced world of finance, liquidity stands out as one of those core concepts that can make or break investment strategies. Whether you’re a seasoned trader navigating stock exchanges or a newcomer dipping your toes into bonds and cryptocurrencies,…

If you’ve been watching the markets in 2025, you might have felt that familiar unease when headlines screamed about the S&P 500 dipping into “correction territory” back in March or April. It’s a term thrown around a lot during volatile…