Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

If you’ve ever wondered why some investors seem to pull ahead while others lag behind despite similar market conditions, the answer often boils down to something deceptively simple: fund fees. Specifically, expense ratios—the annual costs baked into mutual funds and…

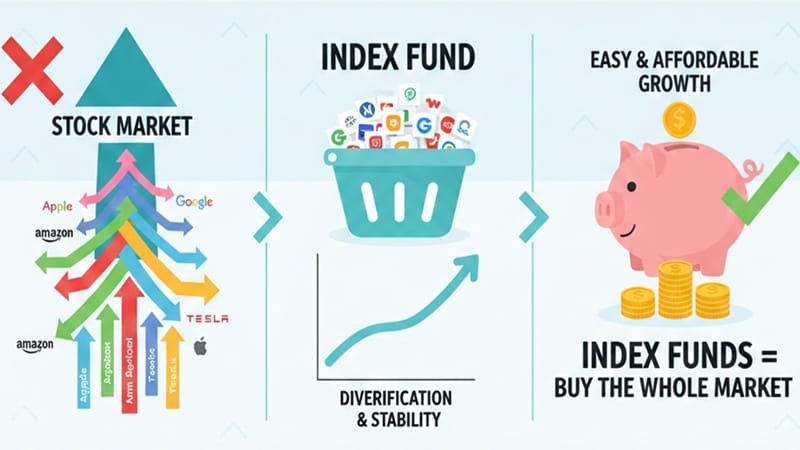

Getting started with investing doesn’t have to be complicated or intimidating. If you’re new to the game and hearing terms like “index funds” tossed around, you’re in the right place. Index funds are straightforward, low-cost, and backed by decades of…

Navigating the world of investments can feel overwhelming, especially when deciding between exchange-traded funds (ETFs) and mutual funds. Both are popular vehicles for building diversified portfolios, but their nuances can significantly impact your returns, taxes, and overall strategy. If you’re…

The debate between actively managed and passive funds has intensified as markets evolve, with trillions shifting based on performance, fees, and investor preferences. In 2025 alone, passive funds pulled ahead in assets, surpassing $19 trillion in the U.S. while active…

In today’s financial landscape, investment funds have become a go-to option for both novice and experienced investors looking to grow their wealth without diving into the complexities of picking individual stocks or bonds. Drawing from years of watching market trends…