Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

For forty years, the global economy has been fueled by a specific demographic fluke: the American Baby Boomers. Born between 1946 and 1964, this generation didn’t just witness the greatest asset super-cycle in history—they were the super-cycle. However, as we…

The financial world is currently intoxicated by a “soft landing” narrative. Markets are flirting with all-time highs, inflation appears to be cooling, and the collective memory of 2008 has faded into a historical footnote. But while the masses chase the…

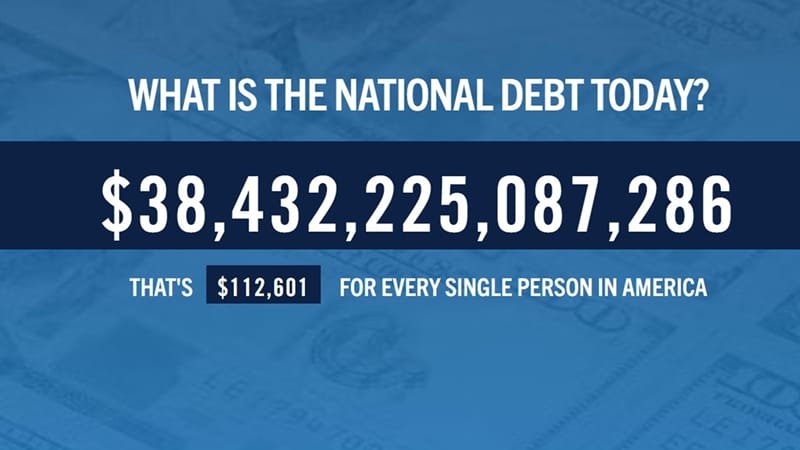

In the shadow of America’s towering $38.4 trillion national debt as of early 2026, a subtle yet profound shift is reshaping the financial landscape. For the first time in history, the U.S. government’s interest payments on this debt have surpassed…

While many institutional forecasts are hedging their bets with “wait-and-see” rhetoric, UBS has broken formation. Their 2026 outlook is arguably the most aggressive roadmap we’ve seen, projecting a 15% global equity surge and a total re-rating of what “value” looks…

In the traditional classroom, we are taught that money is a medium of exchange—a neutral tool that evolved from bartering seashells to minting gold. But if you look at the tectonic shifts in global geopolitics today—from the freezing of national…

Vanguard latest 2026 global economic outlook, released amid a volatile year-end in 2025, stands out for its measured caution on U.S. equities and emphasis on diversified, cycle-proof strategies. Drawing from Vanguard’s data, historical parallels, and cross-referenced insights from sources like…

JPMorgan reports, back to their pre-2008 crisis calls—I’ve always appreciated their blend of macro prudence and sector-specific sharpness. Their latest 2026 outlook on Chinese assets, pieced together from various firm publications including their fixed income perspectives and global wealth management…

In an economy that’s always in flux, the word “recession” often sparks worry—especially when headlines buzz about slowing growth or rising unemployment. As someone who’s guided clients through multiple economic cycles over the years, I’ve seen firsthand how being proactive…

In today’s economic landscape, where prices seem to climb without warning, understanding what is inflation isn’t just academic—it’s crucial for anyone looking to safeguard and grow their investments. Whether you’re a seasoned investor navigating market volatility or someone building a…

In the fast-paced world of finance and investing, few metrics carry as much weight as Gross Domestic Product, or GDP. It’s the go-to measure for gauging a country’s economic health, and savvy investors keep a close eye on it because…

Inflation is one of those economic concepts that affects everyone—from everyday shoppers to policymakers at the Federal Reserve. But when it comes to tracking it, two key metrics often dominate the conversation: the Consumer Price Index (CPI) and the Personal…