Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

The global financial order isn’t just shifting; it’s being demolished and rebuilt in real-time. By early 2026, the traditional “Petrodollar” architecture that defined the post-WWII era has effectively collapsed, replaced by a more aggressive, volatile, and resource-backed synthesis: The AI-Resource Dollar.

To understand the chaos of 2026—from the military annexation of Venezuelan oil flows to the criminal probes into the Federal Reserve leadership—one must look past the headlines and follow the mechanics of debt liquidation.

The pivot point for this radical shift is what historians call the Ferguson Moment. Named after Niall Ferguson, it describes the terminal phase of an empire when the cost of servicing its debt exceeds its defense budget.

In 2026, the U.S. reached this Rubicon:

When interest eats the military, the “Contract” model of the dollar—where U.S. security is traded for currency hegemony—fails. With BRICS nations now settling over 45% of trade in local currencies, the U.S. has pivoted from a “Global Manager” to a “Resource Predator.”

Donald Trump’s primary objective in 2026 is the dilution of the $38.5 trillion debt. There are only two ways to handle such a sum: default or debasement. Trump has chosen the latter, necessitating a “captured” Federal Reserve.

The criminal investigation into Jerome Powell—ostensibly over office renovations—is a tactical maneuver to force a pivot to massive rate cuts. By engineering a “Weak Dollar,” the U.S. effectively pays back its creditors with currency that has 10–15% less purchasing power annually.

| Feature | The Old “Petrodollar” (1974-2024) | The New “Resource-AI” Dollar (2026+) |

| Primary Anchor | Saudi Crude & Global Trust | Rare Earths, Lithium, & Controlled Oil |

| Enforcement | International Law & Trade Pacts | Kinetic Military Control & Sanctions |

| Fed Status | Independent / Inflation-Averse | Treasury-Controlled / Growth-Obsessed |

| Tech Driver | Internet & Software | LLMs & Autonomous Robotics (AI) |

| Debt Strategy | Rollover & Growth | Inflationary Dilution |

If you devalue your currency to kill debt, you risk hyperinflation and domestic unrest. To prevent a “Weimar scenario,” the U.S. is aggressively seizing physical “anchors” to artificially suppress domestic prices.

The “Resource Dollar” is merely a bridge. The end goal is the AI Dollar.

The logic is brutal but mathematically sound: if AI can trigger an exponential explosion in productivity (through nuclear fusion breakthroughs or fully autonomous manufacturing), the $38.5 trillion debt becomes manageable as a percentage of a vastly larger GDP.

However, AI requires two things: infinite energy and infinite compute.

By 2026, the U.S. has stopped trying to be the world’s “Banker” and has started acting as the world’s “Owner.”

The intellectual justification for this radicalism stems from a rejection of traditional austerity. Much like the 2010 Reinhart-Rogoff paper—which famously had a coding error that erroneously suggested high debt kills growth—the 2026 administration believes the “rules” of economics are flexible for those who control the world’s physical resources.

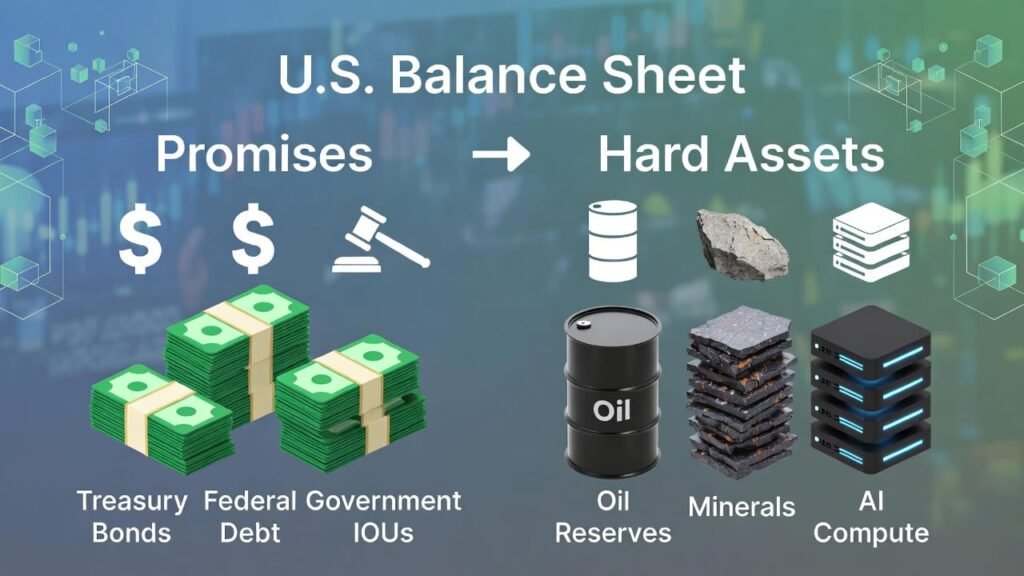

For investors and global observers, the takeaway is clear: Do not look at the rhetoric; look at the collateral. The U.S. is moving its balance sheet from “Promises” (Treasuries) to “Hard Assets” (Oil, Minerals, and AI Compute).

The world of 2026 is no longer governed by the “Invisible Hand” of the market, but by the “Visible Fist” of resource nationalism. Whether this leads to a second American century or a global systemic collapse depends entirely on whether the AI productivity miracle arrives before the debt-fueled inflation bomb detonates.