Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

For decades, financial markets have offered a comforting rhythm, a predictable ebb and flow that investors, much like migratory birds, have relied upon to chart their course. In the cryptocurrency sphere, this rhythm was epitomized by Bitcoin’s celebrated four-year cycle, a pattern that, for many, became an article of faith. Similarly, traditional finance often observed seasonal regularities, such as the typical volatility surrounding US midterm election years. These established patterns provided a sense of order, guiding the allocation of capital and shaping investment strategies. However, as we navigate the transition from 2025 into 2026, this familiar order appears to be dissolving, replaced by a market dynamic that is both perplexing and profound.

On the surface, many perceive a period of muted volatility and sluggish growth, a seemingly uneventful landscape. Yet, beneath this placid exterior, a monumental shift is underway. In the shadows, away from the mainstream spotlight, hundreds of thousands of Bitcoin are being absorbed by an unseen, colossal force. Concurrently, humanity is witnessing an unprecedented technological revolution: Artificial Intelligence (AI) is reshaping the global technological landscape in ways previously unimaginable. This article aims to pierce through these superficial observations, dissecting the underlying logic often overlooked by mainstream media. We will explore the demise of Bitcoin’s four-year cycle, the clandestine accumulation strategies of major players, the perplexing disinflationary period in the US macroeconomic landscape as indicated by the Purchasing Managers’ Index (PMI), and the systemic fraud amounting to trillions of dollars that often escapes scrutiny. This is not merely an analysis of wealth dynamics; it is a critical examination of how individuals can maintain clarity and make informed decisions in this rapidly evolving new era.

For a considerable period, Bitcoin enthusiasts adhered to a doctrine almost religious in its conviction: the four-year cycle. This dogma posited a predictable sequence of one year of ascent, followed by a year of decline, with a ferocious bull market inevitably erupting within a year of each halving event. This framework proved remarkably accurate in 2012, 2016, and 2020. However, a retrospective glance from the vantage point of early 2026 reveals that this theory has been fundamentally invalidated . The market trajectory from 2023 to 2025 has entirely deviated from historical precedents, failing to deliver the anticipated straightforward, linear explosions in value. Instead, we have witnessed a highly complex and rapidly shifting pattern of volatility.

Consider the events of December 2025, when the market was gripped by widespread pessimism over Bitcoin’s decline, anticipating a prolonged crypto winter. Yet, within merely two days of January 2026, the previous month’s 3% dip was not only erased but surpassed. This rapid recovery capability signals a profound transformation in the structure of market participants. We are now at the precipice of a new paradigm, one where historical data offers limited guidance and conventional models prove inadequate. The primary reason for this cyclical breakdown lies in a deep-seated fracture within the consensus relationship that previously governed Bitcoin’s market dynamics .

To illustrate this profound shift, let us compare the characteristics of previous Bitcoin cycles with the emerging reality of 2024-2026. The traditional four-year cycle was largely driven by retail investor sentiment and the predictable supply shock of halving events. However, the current landscape is increasingly dominated by institutional capital, leading to a more mature, yet less explosively volatile, market .

| Feature | Traditional 4-Year Cycle (Pre-2024) | 2024-2026 Emerging Reality |

| Primary Driver | Retail FOMO (Fear Of Missing Out), Halving Supply Shocks | Institutional Adoption, Macro Demand for Alternative Stores of Value |

| Price Volatility | High, characterized by rapid parabolic surges and deep corrections | More tempered, steadier advance, less dramatic surges |

| Market Liquidity | Lower, susceptible to large price swings | Higher, leading to more stable price action |

| Peak Returns | Often >1000% within a year | More moderate, e.g., ~240% in year to March 2024 |

| Market Structure | Fragmented, less regulated | Increasingly integrated with traditional finance, clearer regulation |

| Investor Profile | Predominantly retail, early adopters | Growing institutional presence (ETPs, corporate treasuries) |

This table underscores a critical transition: Bitcoin is evolving from a speculative retail asset into a strategic reserve akin to digital gold, driven by the sustained demand from institutional players rather than the frenetic pace of individual investors. This institutional gravity is fundamentally altering its market behavior, rendering past cyclical predictions obsolete.

The most compelling evidence of this new paradigm lies in the staggering rate at which Bitcoin’s supply is disappearing from the open market. A simple calculation reveals a startling truth. Under the current halving mechanism, the daily new supply of Bitcoin is capped at approximately 450 coins. This translates to an annual production of just over 164,000 BTC. Even if we account for the pre-halving production rate of 900 BTC per day in early 2024, the total new supply over the past two years barely reaches 500,000 BTC. While this may seem like a substantial number, it is a mere drop in the ocean when compared to the voracious appetite of institutional giants.

Let’s examine the scale of this accumulation. In the past two years, global spot Bitcoin ETFs have quietly absorbed over 1.3 million BTC. MicroStrategy (now often referred to as MST2 in this context), a vocal proponent of the corporate Bitcoin standard, has amassed a staggering 670,000 BTC. Add to this the estimated 400,000-500,000 BTC held by other publicly traded companies, and the total institutional holdings from these three sources alone exceed 2.4 million BTC. This means that institutional investors have consumed four to five times the total number of Bitcoins mined during the same period. This is not merely purchasing; it is a systematic, physical clearing of the available supply. As these “black holes”—entities that are unlikely to sell in the short to medium term—siphon off the circulating supply, the traditional cyclical logic, which relies on a more fluid market, inevitably collapses.

Another perplexing phenomenon of the 2024-2025 period has been the curious divergence between Bitcoin and traditional safe-haven assets. While gold consistently set new all-time highs and silver demonstrated remarkable strength in late 2025, Bitcoin, often touted as “digital gold,” lagged behind its precious metal counterparts. This type of decoupling is historically rare and typically unsustainable. Once the price of gold and silver reaches a certain premium, astute capital naturally flows towards assets with similar properties but which have not yet experienced a comparable price surge. This creates a “coiled spring” effect, where the longer the asset is suppressed, the more explosive its eventual breakout.

Furthermore, a critical but often overlooked variable is global liquidity. Despite a general feeling of economic hardship, the global liquidity index has been steadily climbing, a situation remarkably similar to the eve of the 2017 bull market. The liquidity is present, but it has not yet fully permeated into the prices of risk assets. It is akin to a rising tide where the ships furthest from shore are lifted first, while those closer in take time to rise. Ultimately, this abundance of currency will lift all boats, and Bitcoin, with its inherent scarcity and growing institutional demand, is poised to be one of the fastest-moving vessels.

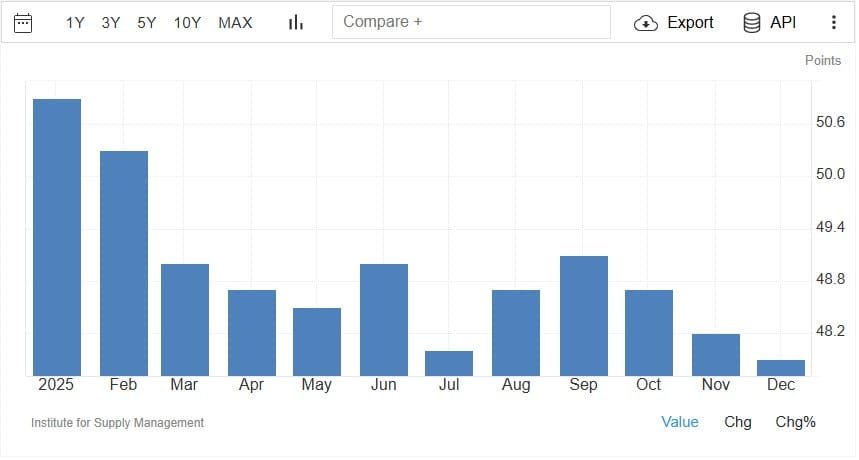

Zooming out from the crypto-specific landscape, the broader US economy is in a state of near-asphyxiation, having endured a manufacturing Purchasing Managers’ Index (PMI) below the critical 50-point threshold for nearly three years. A PMI below 50 indicates contraction, and such a prolonged period of low business confidence is unprecedented in Bitcoin’s history. This clearly demonstrates that the relentless pressure of high interest rates has effectively halted corporate expansion. However, a crucial principle of investing is to never capitulate just before the dawn. History has repeatedly shown that extremes are inevitably followed by a reversion to the mean. A three-year period of intense suppression does not necessarily signify decay; rather, it suggests that a powerful business rebound is gathering momentum. Once the PMI decisively breaks above 50, coupled with the Federal Reserve’s transition to a lower interest rate environment, a new wave of commercial prosperity is likely to be unleashed. This macroeconomic recovery will serve as a powerful tailwind for both Bitcoin and the broader stock market.

Before embracing the promise of renewed prosperity, it is imperative to confront the fundamental truth about currency. The forthcoming economic revival, at its core, is predicated on the continuous expansion of fiat currency and an ever-growing mountain of debt. To illustrate this profound concept, let us consider a compelling historical example.

Rewind to 1964. The minimum wage in the United States stood at $1.25 per hour. Crucially, this $1.25 was not merely paper; it represented five silver quarters, each containing 90% pure silver. If a worker from that era had chosen to save these five silver coins, rather than spending them, and passed them down through generations, their metallic value today, based on current silver prices, would be approximately $65. While the nominal value has increased from $1.25 to $65, the underlying purchasing power, embodied by those five silver coins, remains essentially unchanged. Conversely, those who held their wealth in paper currency have witnessed a silent, yet devastating, erosion of their assets, with a purchasing power reduction of up to 98% .

This narrative has played out countless times throughout human history. The late Roman Empire, facing immense expenditures, progressively debased its silver coinage, a practice that ultimately contributed to its downfall. Today, the exponential growth of national debt is, in essence, a modern form of purity dilution. In an era where debt scales exponentially, the cash held in one’s hand is no longer a bastion of wealth but rather a rapidly depreciating IOU. This fundamental truth underscores the imperative to embrace hard assets—those possessing intrinsic value, independent of any governmental promise or decree.

As we scrutinize the macroeconomic fabric, a gaping chasm of systemic fraud emerges within the US economy. Elon Musk once controversially suggested that the US grappled with $500 billion in fraud annually, a figure many deemed exaggerated. However, recent investigations paint an even more alarming picture: the annual leakage from various welfare loopholes and fraudulent schemes across the nation now exceeds a staggering $1.5 trillion .

Consider the egregious case in Minnesota, where a specific community, through the systematic exploitation of welfare programs, allegedly siphoned off funds exceeding the entire GDP of their country of origin. Even more disconcertingly, reports have linked an official from the United Nations Security Council to large-scale Medicaid fraud . The irony is stark: an ordinary citizen transferring $600 via a mobile app or claiming an extra $200 deduction on their taxes faces intense scrutiny from regulatory bodies. Yet, in the face of systemic fraud amounting to billions, even trillions, the bureaucratic apparatus appears paralyzed, often turning a blind eye. This profound disparity in enforcement and the resulting erosion of trust are tearing at the social consensus of American society. Consequently, discerning capital is accelerating its exodus from traditional systems, seeking refuge in decentralized, hard assets that are immune to bureaucratic inertia and corruption.

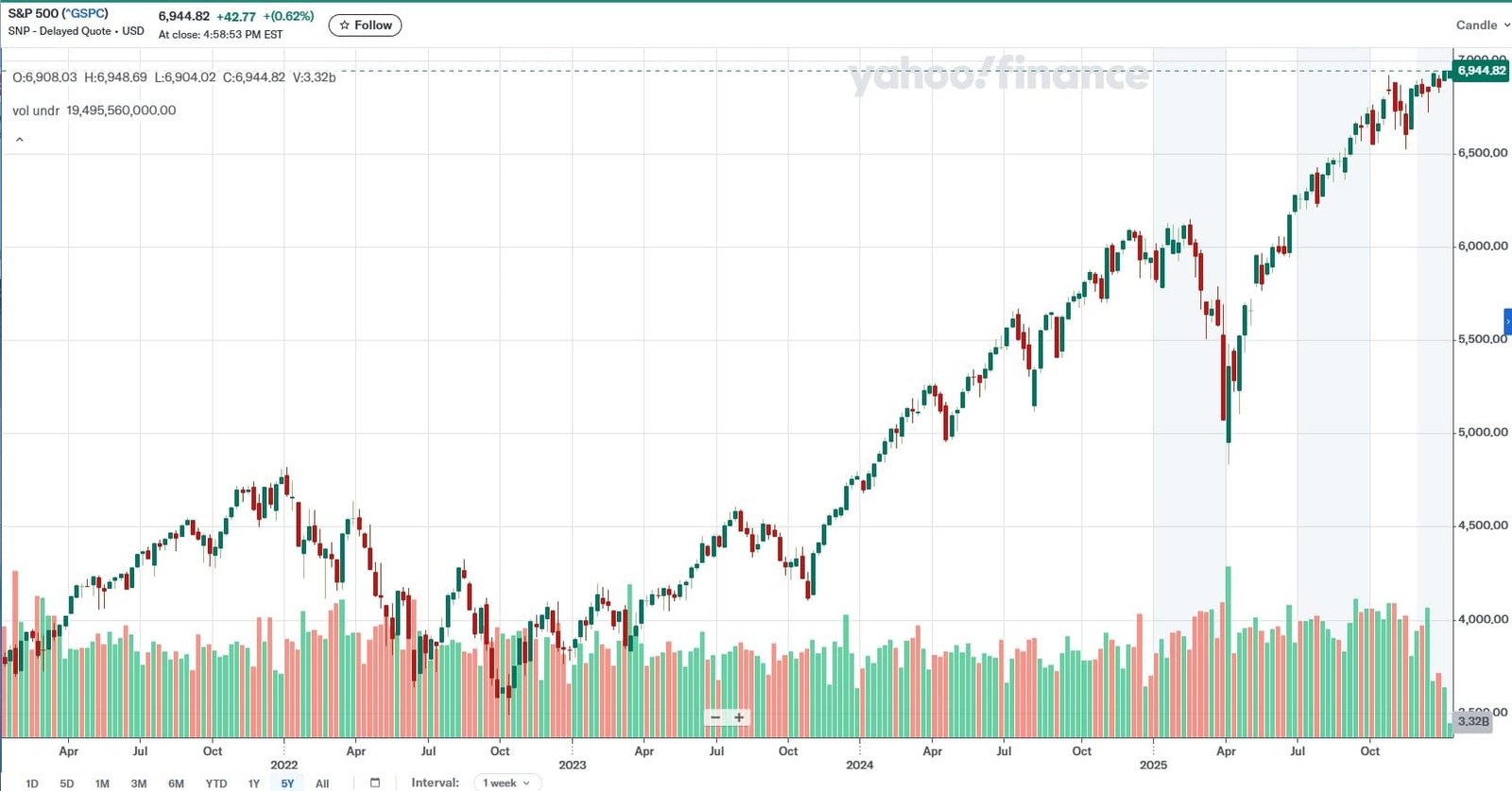

If the fluctuations of the macroeconomic climate are akin to weather patterns, then the advent of Artificial Intelligence is a colossal meteor impacting Earth, fundamentally altering the landscape. While many still debate whether AI constitutes a bubble, empirical data unequivocally demonstrates that AI is not a fleeting concept but the absolute core driver of the S&P 500’s ascent . The so-called “Magnificent Seven” tech giants have transcended their roles as mere product and software companies. Leveraging their immense computational power and data advantages, they are transforming into the digital world’s equivalent of utility companies—monopolistic providers of essential infrastructure. The nearly 80% surge in the S&P 500 over the past three years is not a reflection of a universally thriving physical economy. Instead, it is a testament to the productivity dividends reaped from AI, which have been almost entirely captured by these top-tier computing and model behemoths . This extreme concentration of profit is the underlying truth sustaining the stock market’s upward trajectory.

This convergence of AI and blockchain technology is also creating new opportunities. As AI systems become more centralized, the need for decentralized, verifiable solutions grows. Blockchain offers primitives for decentralized AI development, verifiable proof-of-personhood systems, and transparent intellectual property tracking, addressing concerns about trust, bias, and ownership in the AI era .

As we stand at the crossroads of 2026, the old cyclical maps are proving obsolete. Bitcoin is transitioning from a speculative instrument to a strategic reserve, akin to digital gold. While macroeconomic headwinds persist—evidenced by the prolonged PMI contraction and the black hole of systemic fraud—the transformative power of the AI revolution and the resurgence of global liquidity are paving the way for a new era. In this dynamic environment, the most invaluable quality is not the foresight to identify the next breakout asset or the prescience to predict market tops; it is patience. True wealth is not generated through frenetic short-term trading; it is cultivated by anchoring oneself to sound underlying principles, holding core assets, and enduring the seemingly mundane, yet profoundly transformative, periods of quiet accumulation. The world is undergoing a paradigm-shifting metamorphosis. In such tumultuous times, our only recourse is to maintain profound critical thinking, uphold independent judgment, and ultimately, grant time the patience it deserves.

[4] Cato Institute. (2025, December 17). The Biggest Fraud in Welfare.

[5] GAO. (n.d.). Fraud & Improper Payments.

[7] Washington Stand. (n.d.). Somalia’s UN Ambassador Linked to Widening Medicaid Fraud Scandal.

[8] Bloomberg. (2026, January 4). Is the AI Boom a Bubble Waiting to Pop? Here’s What History Says.

[11] Warren Buffett’s Handover: Greg Abel Takes the Helm at Berkshire Hathaway