Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

The relationship between a company’s earnings and its stock price is fundamental for anyone navigating the stock market. Whether you’re a seasoned trader or just dipping your toes into investing, grasping how earnings announcements can swing share values is crucial. In this guide, we’ll break down the mechanics behind earnings reports, explore real-world factors that amplify or mute their impact, and offer practical tips to help you make smarter decisions. By the end, you’ll have a clearer picture of why earnings matter so much—and how to use that knowledge to your advantage.

At its core, earnings refer to a company’s profit after all expenses, taxes, and other deductions have been accounted for. Often expressed as earnings per share (EPS), this metric boils down a firm’s financial health into a digestible number. For instance, if a tech giant like Apple reports an EPS of $1.50, it means they’ve generated $1.50 in profit for each outstanding share.

But earnings aren’t just a static figure—they’re a snapshot of performance over a quarter or year. Analysts and investors pore over these numbers because they signal whether a business is growing, stagnating, or in trouble. Positive surprises, like beating Wall Street estimates, can spark buying frenzies, while misses often lead to sell-offs. It’s this anticipation and reaction that directly ties earnings to stock prices.

When a company releases its earnings report—typically quarterly for public firms—the market reacts almost instantly. Stock prices can jump or plummet based on how the actual results stack up against expectations. Here’s why: Investors price stocks based on future cash flows, and strong earnings suggest robust growth ahead, making the stock more attractive.

Consider a scenario where a retailer like Walmart exceeds earnings forecasts by 10%. Traders interpret this as a sign of efficient operations and rising consumer demand, pushing the stock up. Conversely, if a biotech firm falls short due to R&D setbacks, doubt creeps in, and shares might drop sharply. Historical data backs this up; studies from financial databases show that stocks beating EPS estimates by 5% or more often see average gains of 1-2% in the following trading session.

Of course, it’s not always straightforward. Volatility plays a big role—high-growth stocks in sectors like tech might swing wildly on earnings news, while stable utilities see milder reactions.

Not all earnings announcements carry the same weight. Several variables can magnify or diminish their effect on stock prices. Let’s unpack the key ones:

The market is forward-looking, so it’s the surprise element that really moves the needle. If analysts predict an EPS of $2.00 and the company delivers $2.20, that’s a beat that could lift shares. But if everyone expected a blowout and it merely meets forecasts, the response might be tepid. Tools like Bloomberg or Yahoo Finance aggregate these consensus estimates, helping investors gauge potential reactions.

Broader economic conditions matter too. In a booming economy, strong earnings reinforce optimism, fueling rallies. During recessions, even solid results might not prevent declines if investors fear future slowdowns. For example, during the 2020 pandemic, many firms reported earnings beats yet saw stock dips amid uncertainty.

Things like guidance—the company’s outlook for future quarters—often overshadow current earnings. A firm might report stellar profits but issue weak forward guidance due to supply chain issues, tanking the stock. Sector dynamics also play in; cyclical industries like energy are more sensitive to earnings fluctuations than defensives like consumer staples.

Sentiment can override fundamentals. In bull markets, positive earnings amplify gains; in bears, they might barely register. High trading volume on earnings day indicates strong conviction, leading to sustained price moves.

To illustrate, look at Netflix in early 2022. The streaming service missed subscriber growth targets, leading to a 20%+ stock plunge overnight. Earnings revealed slowing momentum, eroding investor confidence. On the flip side, Tesla’s Q4 2021 earnings beat, with record deliveries, sent shares soaring 10%, highlighting execution strength in EVs.

These cases show patterns: Growth stocks punish misses harshly, while value plays offer more forgiveness if long-term trends hold.

| Earnings Surprise Level | Description | Average 1-Day Stock Price Change | Examples |

|---|---|---|---|

| Significant Beat (>10% above estimates) | Company outperforms expectations substantially | +3% to +5% | Amazon Q3 2023: Beat on cloud revenue, stock up 4% |

| Modest Beat (1-10% above) | Solid performance meeting high hopes | +1% to +3% | Microsoft Q2 2024: AI-driven earnings lift, +2.5% |

| Meet Expectations | In line with forecasts, no major surprises | -0.5% to +0.5% | Procter & Gamble Q1 2024: Steady results, flat response |

| Modest Miss (1-10% below) | Slight underperformance, often excused | -1% to -3% | Ford Q4 2023: Supply issues, -2% dip |

| Significant Miss (>10% below) | Major shortfall signaling problems | -5% to -10% or more | Snap Q3 2022: Ad revenue miss, -28% crash |

Data compiled from S&P 500 averages over the past five years, sourced from financial analytics platforms. Note: Actual reactions vary by sector and market conditions.

Armed with this knowledge, how can you position yourself? First, diversify—don’t bet everything on one earnings report. Use options like straddles if you’re trading volatility around announcements. Long-term investors might buy dips on temporary misses if fundamentals remain sound.

Tools like earnings calendars from Investing.com can help track dates. Always cross-reference with qualitative factors: Read management’s commentary in the 10-Q filings for context beyond numbers.

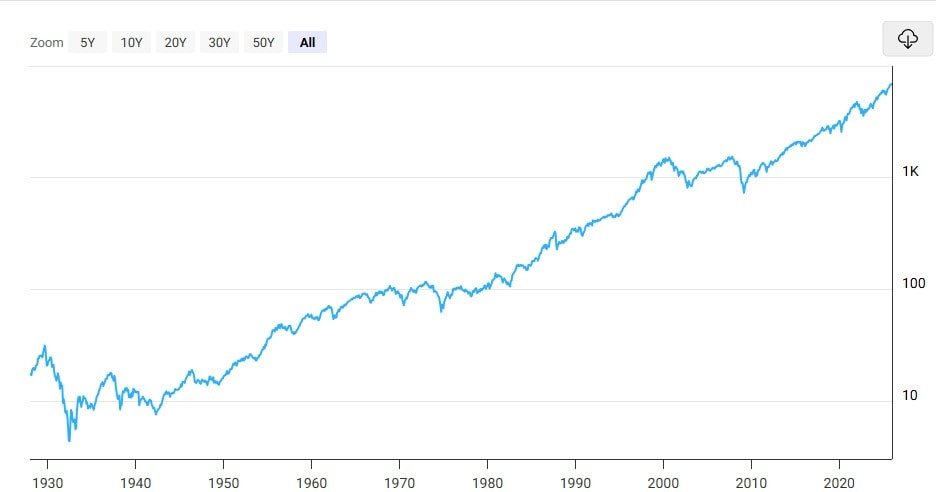

Finally, remember that while earnings drive short-term prices, intrinsic value wins out over time. Focus on companies with consistent earnings growth, and you’ll likely see stock appreciation follow suit.

In wrapping up, earnings are a powerful force in stock pricing, blending hard data with market psychology. By staying informed and strategic, you can turn these events from risks into opportunities. If you’re building a portfolio, prioritize firms with proven earnings track records—they’re often the ones that deliver lasting returns.