Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

In the fast-paced world of finance, liquidity stands out as one of those core concepts that can make or break investment strategies. Whether you’re a seasoned trader navigating stock exchanges or a newcomer dipping your toes into bonds and cryptocurrencies, grasping liquidity helps you anticipate how smoothly assets can be bought or sold without causing wild price swings. I’ve spent years analyzing market dynamics, from Wall Street’s bustling floors to emerging digital asset platforms, and liquidity remains a pivotal factor in every decision. This guide breaks it down step by step, drawing on real-world examples and practical insights to help you integrate this knowledge into your financial toolkit.

At its heart, liquidity in financial markets refers to the ease with which an asset can be converted into cash—or another asset—without significantly impacting its price. Think of it as the market’s “flow”: high liquidity means assets move quickly and at predictable prices, much like water rushing through a wide river. Low liquidity, on the other hand, is like a narrow stream clogged with rocks—transactions become sluggish, and prices can fluctuate dramatically.

This isn’t just academic jargon. In practice, liquidity affects everything from daily trading volumes to the stability of entire economies. For instance, during the 2008 financial crisis, liquidity dried up in mortgage-backed securities, leading to massive sell-offs and frozen markets. Today, with global markets interconnected via technology, understanding liquidity helps investors spot opportunities and risks early.

Market liquidity isn’t uniform; it varies across asset classes. Stocks on major exchanges like the NYSE often boast high liquidity due to millions of daily trades, while niche commodities or illiquid real estate might require weeks to sell without slashing prices.

Liquidity isn’t a one-size-fits-all term—it’s multifaceted, and recognizing its types can sharpen your investment edge. Broadly, we categorize it into market liquidity and funding liquidity.

Market liquidity focuses on how quickly and cheaply you can trade an asset in the open market. High market liquidity is evident in blue-chip stocks or major currency pairs like EUR/USD, where bid-ask spreads are tight, and large orders don’t budge prices much.

Funding liquidity, meanwhile, deals with the availability of cash or credit to finance trades. This became painfully clear in 2020’s COVID-19 market turmoil, when even solvent firms struggled to secure short-term loans amid panic.

There’s also asset-specific liquidity, which varies by instrument:

Understanding these distinctions empowers you to diversify wisely—mixing high-liquidity assets for quick exits with lower-liquidity ones for potential higher returns.

Liquidity isn’t just a trader’s concern; it’s the grease that keeps the financial engine running. For individual investors, high liquidity means lower transaction costs and faster portfolio adjustments. Imagine needing to sell shares during a market dip—if liquidity is ample, you exit at a fair price. If not, you might take a hefty loss just to offload them.

On a macro level, liquidity supports economic growth by enabling efficient capital allocation. Central banks, like the Federal Reserve, often intervene with quantitative easing to boost liquidity during downturns, as seen in post-2008 policies that flooded markets with cash.

But beware the double-edged sword: excessive liquidity can inflate asset bubbles, as witnessed in the 2021 meme stock frenzy with GameStop. Low liquidity, conversely, amplifies shocks, turning minor sell-offs into crashes. As an investor, prioritizing liquidity in your strategy—say, by favoring ETFs over obscure derivatives—can safeguard against such volatility.

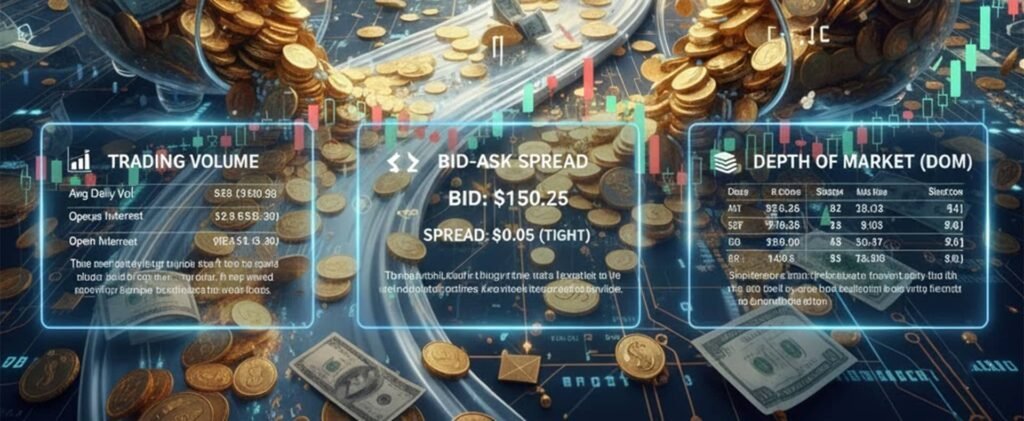

Quantifying liquidity turns abstract ideas into actionable data. Several metrics help gauge it, each offering a unique lens.

Here’s a straightforward table summarizing the most common measures:

| Metric | Description | How It’s Calculated | Example in Use |

|---|---|---|---|

| Bid-Ask Spread | The difference between the highest buy price and lowest sell price. Tight spreads indicate high liquidity. | Sell price minus buy price. | A stock with a $0.01 spread is more liquid than one with $0.50. |

| Trading Volume | Total shares or units traded in a period. Higher volume suggests better liquidity. | Sum of trades over a day/week/month. | Apple Inc. often sees billions in daily volume, signaling strong liquidity. |

| Turnover Ratio | Measures how often assets are bought/sold relative to market cap. | Trading volume divided by market capitalization. | A ratio above 1 means the asset turns over fully annually. |

| Amihud Illiquidity | Captures price impact per unit of volume. Higher values mean lower liquidity. | Absolute return divided by dollar volume. | Useful for comparing illiquid emerging market stocks. |

| Market Depth | Volume available at various price levels in the order book. | Sum of orders at bid/ask levels. | Crypto exchanges display this in real-time for traders. |

These tools aren’t infallible—market conditions can shift them overnight—but tracking them via platforms like Bloomberg or Yahoo Finance gives you a competitive advantage. For beginners, start with bid-ask spreads; they’re simple yet revealing.

Liquidity doesn’t exist in a vacuum; it’s shaped by a web of influences. Market size plays a starring role—larger markets like forex (with $7.5 trillion daily turnover) naturally offer more liquidity than smaller ones like municipal bonds.

Economic conditions are crucial too. Bull markets swell liquidity as confidence draws participants, while recessions scare them away. Regulatory changes, such as post-crisis banking reforms, can either enhance (via transparency rules) or hinder (via capital requirements) liquidity.

Technology has revolutionized this: High-frequency trading algorithms boost liquidity in normal times but can withdraw en masse during stress, exacerbating flash crashes like 2010’s Dow plunge.

Global events, from geopolitical tensions to pandemics, add unpredictability. For decision-making, assess these factors holistically—perhaps by monitoring news feeds alongside metrics—to time entries and exits effectively.

No discussion of liquidity is complete without addressing risks. Liquidity risk arises when you can’t sell an asset quickly enough at a reasonable price, potentially locking in losses. This hit hedge funds hard in 2008, forcing fire sales.

To mitigate, diversify across liquid assets, maintain cash reserves, and use stop-loss orders. For institutions, stress testing portfolios against liquidity scenarios is standard practice.

In crypto markets, where liquidity can vanish overnight due to exchange hacks or regulatory news, sticking to established platforms like Binance or Coinbase reduces exposure.

Looking ahead, liquidity is evolving with innovations. Decentralized finance (DeFi) platforms like Uniswap automate liquidity provision via pools, offering yields but with impermanent loss risks.

Sustainable investing, too, sees varying liquidity—green bonds from governments are liquid, while niche ESG startups lag. As these sectors grow, expect liquidity to deepen, creating fresh opportunities.

Mastering liquidity in financial markets isn’t about memorizing definitions—it’s about applying them to real decisions. Whether you’re building a retirement fund or day-trading, prioritize assets with solid liquidity to minimize surprises. Monitor metrics, stay informed on global shifts, and always have an exit plan. By doing so, you’ll navigate markets with confidence, turning potential pitfalls into advantages.

If you’re ready to dive deeper, consider tools like liquidity scanners in trading apps or consulting a financial advisor tailored to your goals. Remember, in finance, knowledge of liquidity isn’t just power—it’s protection.