Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

In today’s economic landscape, where prices seem to climb without warning, understanding what is inflation isn’t just academic—it’s crucial for anyone looking to safeguard and grow their investments. Whether you’re a seasoned investor navigating market volatility or someone building a nest egg for retirement, grasping how inflation works can mean the difference between watching your wealth erode or positioning it to thrive. Drawing from years of observing market cycles, I’ve seen how unchecked inflation can quietly undermine even the most carefully planned portfolios. In this guide, we’ll break down what inflation really means, why it happens, and most importantly, how it affects your money. By the end, you’ll have actionable steps to make smarter decisions that align with your financial goals.

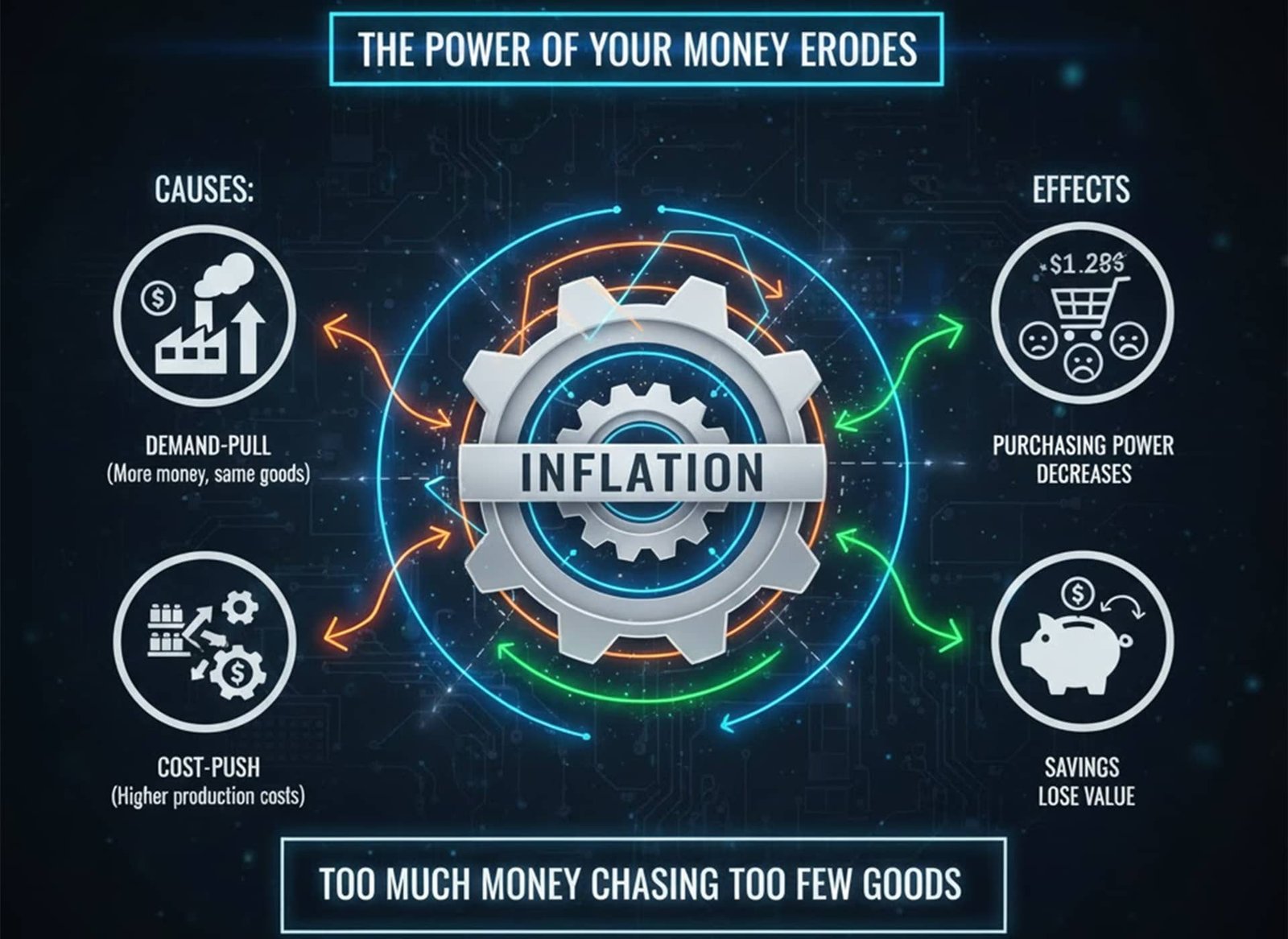

At its core, inflation represents a steady rise in the prices of goods and services over time, which directly chips away at the purchasing power of your money. Think about it this way: if a cup of coffee costs $3 today, but inflation pushes that to $3.30 next year, your dollar buys less. This isn’t about isolated price hikes, like a sudden jump in gas due to a supply glitch—it’s a broad, ongoing trend across the economy. Economists often describe it as too much money chasing too few goods, leading to a devaluation of currency. While a touch of inflation—around 2% annually, as targeted by central banks like the Federal Reserve—signals a healthy, growing economy, higher rates can spell trouble. It forces consumers to spend more on essentials, leaving less for savings or investments, and it compels investors to seek returns that at least keep pace to avoid losing ground in real terms.

From my experience advising clients through various economic shifts, mild inflation encourages spending and investment, as people anticipate higher future prices. But when it spikes, it can create uncertainty, prompting businesses to hesitate on expansions and individuals to rethink their budgets. The key takeaway? Inflation isn’t inherently bad, but ignoring it can be costly for your long-term financial health.

Inflation doesn’t emerge out of thin air; it’s driven by a mix of economic forces that interplay in complex ways. One major driver is demand-pull inflation, where consumer demand outstrips supply. This often happens during economic booms—think post-recession recoveries when people are eager to spend, but production hasn’t caught up yet. Governments pumping money into the economy through stimulus can exacerbate this, as seen in recent years with pandemic-related aid leading to rapid price increases in everything from lumber to used cars.

Another culprit is cost-push inflation, triggered by rising production expenses. When raw materials like oil or wages climb—perhaps due to labor shortages or global disruptions—businesses pass those costs onto consumers to protect their margins. For instance, a poor harvest driving up flour prices might force bakeries to charge more for bread, rippling through the food chain. Then there’s built-in inflation, a self-perpetuating cycle where workers demand higher pay to offset rising living costs, and companies in turn hike prices, creating a wage-price spiral.

In my professional view, these causes aren’t isolated; they often overlap, amplified by external shocks like geopolitical events or supply chain bottlenecks. Recognizing these triggers helps investors anticipate shifts and adjust accordingly, rather than reacting after the fact.

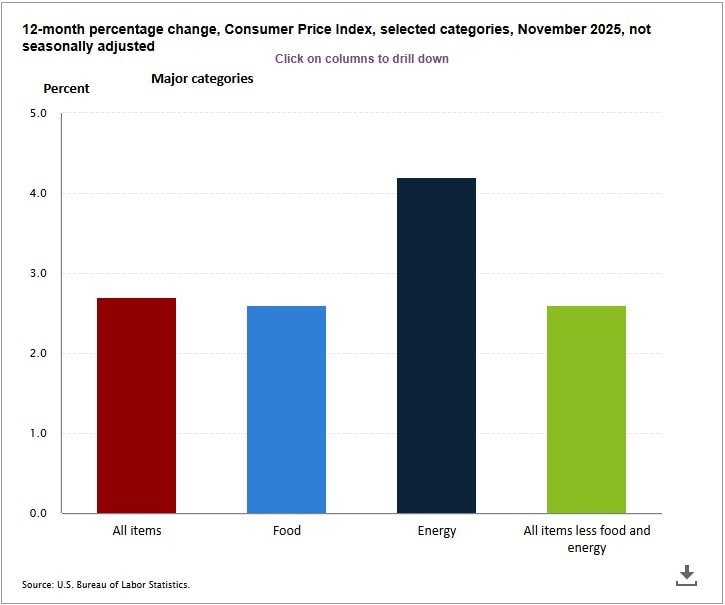

To make informed decisions, you need reliable ways to track inflation. The most common tool is the Consumer Price Index (CPI), which monitors the average price changes for a basket of everyday items—food, housing, transportation, and more—over time. In the U.S., the Bureau of Labor Statistics calculates this monthly, comparing it to the previous year to derive the inflation rate. For example, if the CPI rises from 100 to 105, that’s a 5% inflation rate.

Other measures include the Producer Price Index (PPI), which looks at wholesale costs, and the Personal Consumption Expenditures (PCE) price index, favored by the Fed for its broader scope. Historically, the U.S. has seen averages around 3-4% over decades, but periods like the 1970s “Great Inflation” pushed rates above 14%, illustrating how volatile it can get. As an investor, keeping an eye on these metrics via trusted sources like the Fed’s reports can signal when to pivot your strategy.

Inflation’s sting is most felt in how it diminishes the real value of your returns. If your portfolio earns 6% but inflation runs at 4%, your actual gain is just 2%—barely enough to maintain purchasing power, let alone build wealth. This erosion hits different asset classes unevenly, and understanding these dynamics is key to building resilience.

Fixed-income investments like bonds suffer the most, as their payouts are locked in, buying less over time. Stocks can fare better long-term, often outpacing inflation through company growth and dividend hikes, though short-term volatility spikes during high-inflation periods. Real estate and commodities, meanwhile, tend to act as natural hedges, with values rising alongside prices.

To illustrate, here’s a breakdown of how common assets typically respond to inflation:

| Asset Class | Impact of Moderate Inflation (2-4%) | Impact of High Inflation (>5%) | Why It Matters for Investors |

|---|---|---|---|

| Bonds | Mild erosion of purchasing power; fixed coupons buy less. | Significant price drops as rates rise; longer-term bonds hit hardest. | Safe havens lose appeal; consider shorter durations for flexibility. |

| Stocks | Generally positive; companies pass on costs via pricing. | Short-term dips, but long-term outperformance (e.g., 11% avg. returns historically). | Growth stocks struggle; value stocks may shine in rising-rate environments. |

| Real Estate | Values often rise with inflation; rents increase. | Strong hedge; demand for tangible assets grows. | Provides income stability; REITs offer accessible entry without direct ownership. |

| Commodities | Neutral to positive; prices track inflation closely. | Often surge (e.g., energy up 59% in high-inflation years). | Diversification tool; gold and oil can protect against currency devaluation. |

This table draws from patterns observed over decades, like how commodities outperformed in 2022 amid 8%+ inflation peaks. For retirees or those on fixed incomes, the effects are amplified, as savings dwindle faster without growth-oriented assets.

The good news? You don’t have to sit idly by. Start by diversifying across assets that historically beat inflation—mix stocks, real estate, and commodities to balance risks. Treasury Inflation-Protected Securities (TIPS) are a standout choice; their principal adjusts with CPI, ensuring your investment keeps up. Floating-rate bonds or funds tied to benchmarks like the Fed’s overnight rate can also adapt as rates climb.

For equity investors, focus on sectors like energy or utilities that can pass on costs through higher prices or dividends. Real estate investment trusts (REITs) provide exposure without the hassle of property management, often yielding returns above inflation. And don’t overlook commodities; a small allocation to gold or oil can serve as insurance during turbulent times.

From my advisory practice, the best approach is tailoring these to your risk tolerance and horizon. If you’re nearing retirement, lean toward protective assets; younger investors might embrace growth stocks for their long-term edge. Always consult a financial advisor to stress-test your plan—small tweaks today can prevent big losses tomorrow.

History offers valuable lessons. The 1970s stagflation era, with double-digit inflation, hammered bonds but saw stocks rebound over time, averaging 8% annual gains despite the chaos. More recently, the 2022 surge to 8.1% in Canada highlighted how global events can fuel rapid rises, yet diversified portfolios weathered the storm better than cash-heavy ones. These episodes underscore that while inflation can disrupt, markets adapt, rewarding patient, informed investors.

Inflation is a persistent force in investing, but with knowledge of its mechanics and impacts, you can turn it from a threat into an opportunity. By measuring it accurately, understanding its causes, and deploying targeted strategies, you’ll be better equipped to protect your wealth and achieve your goals. Whether inflation simmers or surges, the decision to act thoughtfully now could define your financial future. If you’re ready to refine your approach, start by reviewing your portfolio against current rates—your future self will thank you.