Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

In the ever-shifting landscape of U.S. stock markets, investors often find themselves pitting major indices against each other to gauge broader trends. The Dow Jones Industrial Average (DJIA) and the Nasdaq Composite stand out as two titans, each representing distinct slices of the economy. As we wrap up 2025—a year marked by volatility, tech-driven rebounds, and geopolitical jitters—the question on many minds is straightforward: between Dow Jones vs. Nasdaq, which is leading the charge? Drawing from recent market data and historical context, this analysis breaks it down to help you make informed decisions for your portfolio.

The Dow Jones Industrial Average, often just called “the Dow,” has been a market staple since 1896. It’s a price-weighted index tracking 30 large, established companies across various sectors, serving as a barometer for industrial and economic health. Think of it as the old guard—reliable, but not always the flashiest.

On the flip side, the Nasdaq Composite, launched in 1971, captures a broader, tech-heavy swath of the market with over 3,000 listings. It’s synonymous with innovation, housing giants in software, biotech, and semiconductors. If the Dow reflects America’s industrial backbone, the Nasdaq embodies its digital future. This Dow Jones vs. Nasdaq comparison isn’t just about numbers; it’s about contrasting stability with growth potential in today’s economy.

At their core, these indices differ in how they’re built and weighted, which directly impacts their performance.

The Dow’s price-weighted approach means higher-priced stocks like UnitedHealth or Goldman Sachs wield more influence, regardless of market cap. This can make it less representative of overall market value but more attuned to blue-chip stability. Its composition leans toward traditional sectors: finance, healthcare, energy, and consumer goods make up the bulk.

Nasdaq, however, is market-cap weighted, so behemoths like Apple, Microsoft, and Nvidia dominate. This tilts it heavily toward technology—about 45% of its weight—and emerging fields like AI and cloud computing. The result? Higher volatility, but also the potential for outsized gains during tech booms.

These structural variances explain why the Nasdaq often surges ahead in innovation-driven markets, while the Dow holds steady amid economic uncertainty. For investors eyeing Dow Jones vs. Nasdaq in 2025, understanding these mechanics is crucial for predicting shifts.

Looking back provides context for today’s leadership debate. Since the early 2000s, both indices have navigated dot-com busts, financial crises, and pandemics, but their paths diverge.

From their 2000 highs through September 2025, a hypothetical $1,000 investment in the Dow (adjusted for inflation) would have grown to around $3,570, yielding a real annual return of about 5.07%. The Nasdaq-100, a subset of the Composite, lagged slightly at $3,267 with a 4.74% return, reflecting its heavier hit from the tech bubble burst. Over the last decade, though, Nasdaq has pulled ahead, up 137% in real terms compared to the Dow’s 109%.

This pattern underscores Nasdaq’s resilience in growth eras, like the post-2020 AI surge, versus the Dow’s steadier climb tied to cyclical industries. History shows neither consistently dominates; leadership flips with economic cycles.

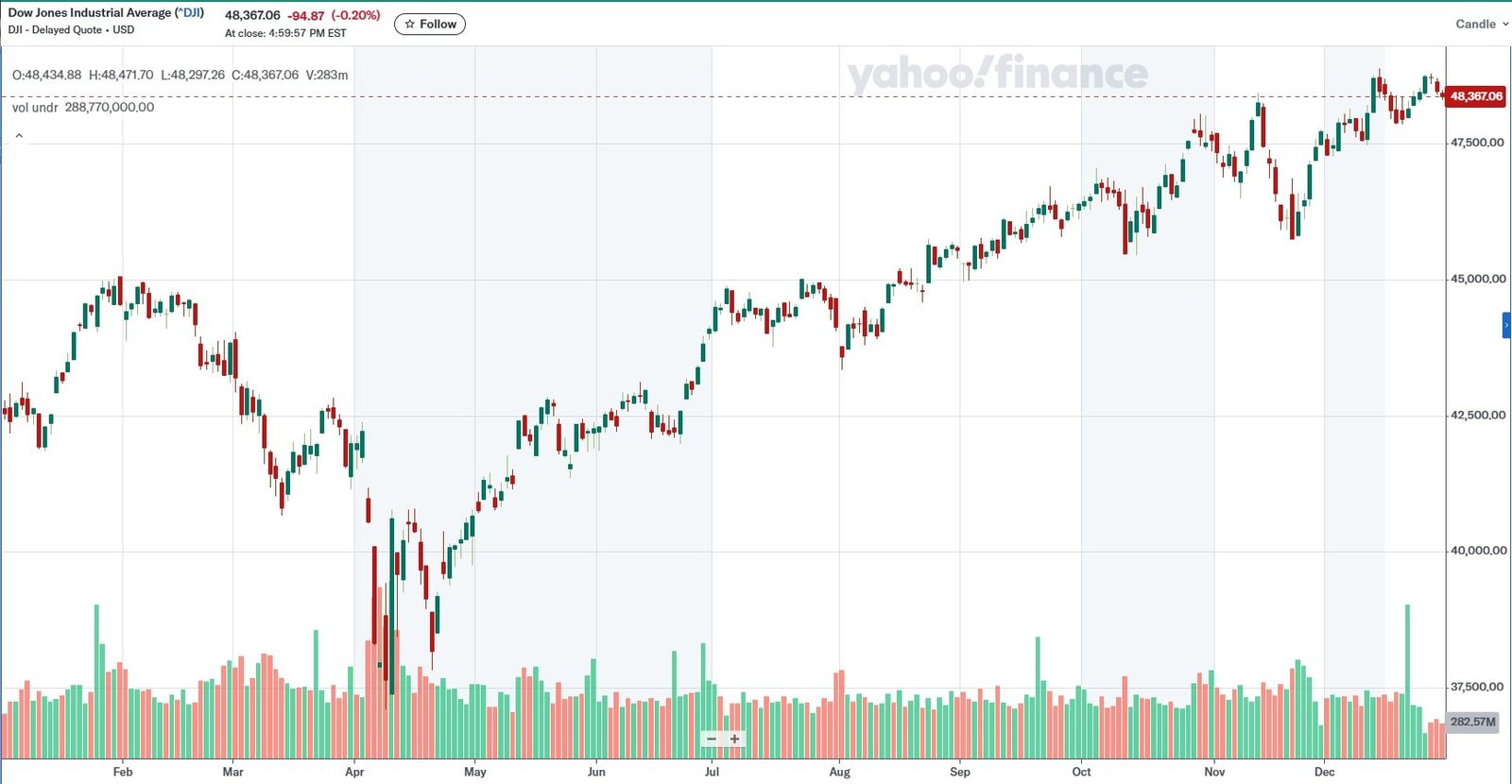

2025 has been a rollercoaster, starting with a January dip triggered by global AI concerns and spring volatility from proposed tariffs under President Trump. Markets rebounded strongly, fueled by Fed rate cuts and corporate earnings strength, pushing indices to new highs.

By year-end, the Nasdaq Composite led with a 21% gain, outpacing the Dow’s 13.7% rise. The S&P 500, often a middle ground, clocked in at 17%. This marks the third straight year of double-digit advances for both, but Nasdaq’s edge highlights tech’s dominance amid AI enthusiasm.

To visualize the Dow Jones vs. Nasdaq showdown, here’s a comparison table based on key metrics:

| Aspect | Dow Jones Industrial Average | Nasdaq Composite |

|---|---|---|

| Number of Components | 30 blue-chip stocks | Over 3,000 stocks |

| Weighting Method | Price-weighted | Market-cap weighted |

| Sector Focus | Industrials, finance, energy | Tech, biotech, growth |

| 2025 YTD Return | +13.7% | +21% |

| Volatility (2025) | Lower (steady amid tariffs) | Higher (AI-driven swings) |

| All-Time High (2025) | Above 48,000 points | Record highs in June |

Data sourced from market reports as of December 2025. These figures show Nasdaq pulling ahead, but the Dow’s resilience in turbulent periods shouldn’t be overlooked.

Several elements have shaped which index is leading this year. Tech innovation, particularly AI, has supercharged Nasdaq stocks like Nvidia and Meta, amplifying gains despite broader market wobbles. Meanwhile, the Dow benefited from strength in banking and energy, but lagged as interest rates fluctuated and trade tensions simmered.

Geopolitical risks, including Middle East conflicts and U.S. policy shifts, added volatility, but Nasdaq’s growth orientation allowed it to recover faster. Inflation cooling and Fed easing further favored riskier assets, tilting the scales toward Nasdaq in this Dow Jones vs. Nasdaq race.

Based on pure performance metrics, the Nasdaq is leading in 2025. Its 21% return eclipses the Dow’s, driven by tech’s outsized role in economic growth. However, “leading” depends on your lens—if you prioritize stability over raw gains, the Dow’s lower volatility makes it a contender in uncertain times.

In my experience advising portfolios, Nasdaq often leads during expansions, as seen this year, while the Dow shines in recoveries. With 2025 closing near records for both, Nasdaq holds the edge, but watch for 2026 shifts if rates rise or tech cools.

For conservative investors, the Dow offers dividends and downside protection—consider ETFs like DIA for exposure. Growth seekers should lean Nasdaq via QQQ, capitalizing on innovation trends. A balanced approach? Blend them for diversification, mitigating Nasdaq’s swings with Dow’s steadiness.

Ultimately, your choice in the Dow Jones vs. Nasdaq debate hinges on risk tolerance and goals. If chasing leadership means higher returns, Nasdaq wins 2025; for reliability, Dow remains a solid pick.

As 2025 draws to a close, the Nasdaq emerges as the frontrunner in this index rivalry, buoyed by tech’s momentum. Yet, the Dow’s enduring strength reminds us that market leadership isn’t static. Stay vigilant on economic indicators, and consider your strategy carefully—whether you’re betting on tradition or transformation, both indices offer pathways to growth. For the latest updates, consult reliable financial sources, and always diversify to weather the storms ahead.