Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Getting started with investing doesn’t have to be complicated or intimidating. If you’re new to the game and hearing terms like “index funds” tossed around, you’re in the right place. Index funds are straightforward, low-cost, and backed by decades of data showing they often outperform flashier options. As we head into 2026, with markets navigating AI growth and economic shifts, index funds remain a cornerstone for beginners. This guide breaks down what index funds are, why they’re ideal for newcomers, and how to get started—drawing from trusted sources like Vanguard, Fidelity, and Morningstar to give you clear, actionable insights.

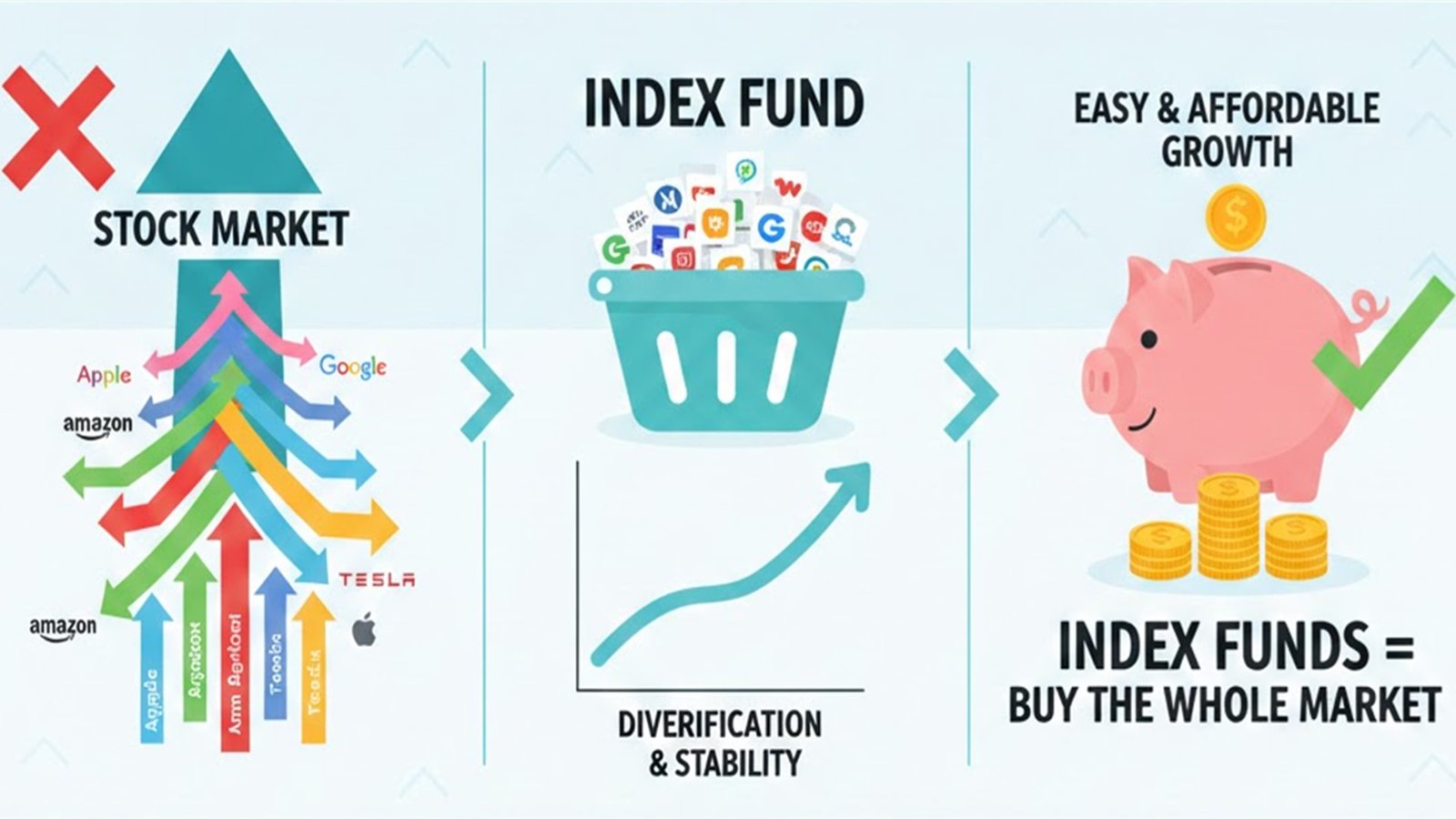

An index fund is essentially a type of mutual fund or ETF that aims to mirror the performance of a specific market index, like the S&P 500, which tracks 500 of the largest U.S. companies. Instead of a manager trying to pick winning stocks, the fund simply holds the same assets as the index in the same proportions. This passive approach means you’re betting on the overall market’s growth rather than outguessing it.

Think of it like this: The S&P 500 represents about 80% of the U.S. stock market’s value. An S&P 500 index fund buys shares in those exact companies—Apple, Microsoft, Amazon, and hundreds more—so your investment rises and falls with the broader economy. No crystal ball needed. Pioneered by John Bogle at Vanguard in the 1970s, index funds have exploded in popularity because they deliver market returns minus tiny fees. As of late 2025, passive index funds hold trillions in assets, often outperforming active strategies where managers charge more to try (and frequently fail) to beat the market.

For beginners, this simplicity is gold: You get instant diversification across hundreds or thousands of stocks, reducing the risk of any single company tanking your portfolio.

Index funds shine for new investors because they strip away complexity while stacking the odds in your favor. Here’s why they’ve become my go-to recommendation:

In my experience, clients who start with index funds stick with investing longer because they see steady growth without the stress of stock-picking mistakes.

The advantages go beyond basics. Index funds are tax-efficient, with lower turnover meaning fewer capital gains distributions. They’re transparent—you know exactly what you own—and accessible, often with no minimums via ETFs.

Historically, the S&P 500’s total returns (price plus dividends) have averaged about 10-11% annually over long periods, turning consistent contributions into serious wealth through compounding. For instance, $500 monthly into an S&P 500 fund at 10% average return could grow to over $1 million in 40 years.

They also foster discipline: Passive investing avoids emotional decisions that derail many newcomers.

With thousands available, focus on broad, low-cost options from reputable providers like Vanguard, Fidelity, and Schwab. These track major indexes and have rock-bottom fees.

Here are standout choices based on 2025 data from Morningstar, Bankrate, and provider reports—ideal for building a simple portfolio:

For bonds to balance risk: Vanguard Total Bond Market ETF (BND).

To help you compare, here’s a snapshot of popular beginner-friendly index funds as of late 2025. Data from Morningstar and fund providers; returns are approximate 10-year annualized (past performance isn’t a guarantee).

| Fund Ticker | Provider | Tracks | Expense Ratio | Min. Investment | 10-Year Avg. Annual Return | Best For |

|---|---|---|---|---|---|---|

| VOO | Vanguard | S&P 500 | 0.03% | $1 (ETF) | ~13.5% | Core U.S. large-cap |

| VTI | Vanguard | Total U.S. Stock Market | 0.03% | $1 | ~13.0% | Broad U.S. exposure |

| SCHB | Schwab | U.S. Broad Market | 0.03% | $1 | ~13.0% | Low-cost total market |

| FNILX | Fidelity | Large-Cap Index | 0.00% | $0 | ~13.8% | Zero-fee starter |

| VT | Vanguard | Total World Stock | 0.07% | $1 | ~9.5% | Global diversification |

| BND | Vanguard | U.S. Aggregate Bond | 0.03% | $1 | ~2.5% | Stability/bonds |

These are ETFs or mutual funds with strong track records; check current prospectuses for updates.

Ready to invest? Follow these steps:

In tax-advantaged accounts like IRAs or 401(k)s, index funds maximize growth.

Index funds aren’t flashy, but they’re reliable—leveling the playing field so beginners can capture market growth without overpaying or overthinking. As markets evolve with tech and global changes, broad exposure keeps you in the game. From what I’ve seen, those who start simple with index funds build confidence and wealth over time. If you’re ready, research a fund that fits, start small, and let compounding do the heavy lifting. Consult a fiduciary advisor for personalized advice, but remember: The sooner you begin, the more time works in your favor. Here’s to your investing journey!