Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

If you’ve ever wondered why interest rates on your mortgage fluctuate or how the government keeps the banking system from collapsing during a crisis, the Federal Reserve—often just called the Fed—plays a starring role. As the central bank of the United States, it’s not just some distant bureaucracy; its decisions ripple through everything from your savings account to the broader economy. In this in-depth look, we’ll unpack exactly what the Federal Reserve is, how it’s built, and the critical roles it plays in keeping things stable. Whether you’re managing personal finances or just trying to make sense of the news, understanding the Fed can give you a real edge in navigating economic ups and downs.

The Federal Reserve didn’t appear out of thin air—it was born from a series of banking disasters that shook the U.S. economy in the early 20th century. Back in 1907, a major financial panic hit, with runs on banks leading to widespread failures and economic turmoil. Without a central authority to step in, the system was vulnerable, and Congress knew something had to change. That’s when President Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913, creating the Fed to provide stability and prevent future crises.

This wasn’t the first attempt at central banking in America; earlier versions like the First and Second Banks of the United States had come and gone amid political debates over federal power. But the 1913 act struck a balance, blending public oversight with private input to make the system more resilient. Over the years, its mandate has evolved, especially after events like the Great Depression and the 2008 financial meltdown, which led to reforms expanding its regulatory reach.

At its core, the Federal Reserve System is a unique hybrid—part government agency, part private entity—designed to insulate it from short-term political pressures while staying accountable. The setup includes three main pillars: the Board of Governors, the 12 regional Federal Reserve Banks, and the Federal Open Market Committee (FOMC).

The Board of Governors, based in Washington, D.C., consists of seven members appointed by the president and confirmed by the Senate for 14-year terms. This staggered structure helps maintain independence, with the chair serving a four-year term that’s renewable. As of late 2025, Jerome Powell continues as chair, overseeing a team that includes key figures like Philip Jefferson as vice chair. The regional banks, spread across districts from Boston to San Francisco, handle day-to-day operations and provide local economic insights. Each has its own president, and they’re owned by member banks in their areas, though profits mostly go back to the U.S. Treasury.

Then there’s the FOMC, the Fed’s policy-making powerhouse. It brings together the Board, the New York Fed president (a permanent member due to Wall Street’s influence), and four rotating presidents from other regions. This group meets about eight times a year to set interest rate targets and guide monetary policy. It’s this decentralized yet coordinated structure that allows the Fed to respond nimbly to national issues while factoring in regional differences, like how manufacturing slumps in the Midwest might differ from tech booms on the West Coast.

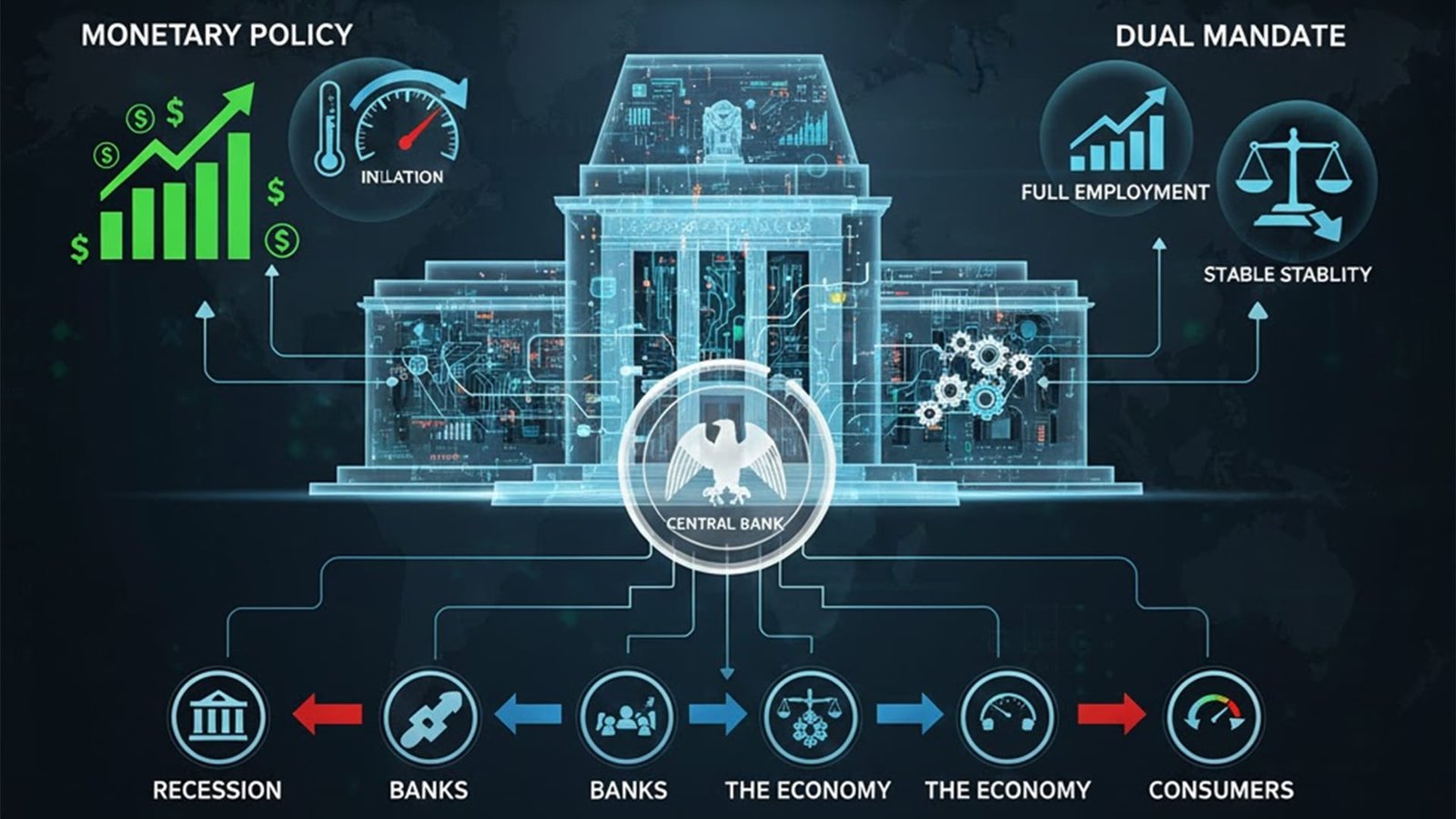

The Fed isn’t just about printing money—though it does oversee that too. Its responsibilities boil down to five key areas, all aimed at promoting a healthy economy and serving the public interest. First and foremost is conducting monetary policy, guided by a dual mandate from Congress: achieving maximum employment and stable prices, ideally around 2% inflation. This means tweaking interest rates and money supply to avoid booms that lead to busts.

Beyond that, the Fed supervises and regulates banks to ensure they’re sound and protect consumers from shady practices. It maintains the stability of the financial system, stepping in as a lender of last resort during crises—like it did in 2008 and 2020. The Fed also runs the nation’s payment systems, processing trillions in transactions daily through services like Fedwire for high-value transfers and FedNow for instant payments, which launched in 2023 to modernize how we move money. Finally, it acts as the fiscal agent for the U.S. government, handling things like issuing Treasury securities and managing federal accounts.

These functions aren’t siloed; they interconnect to create a safety net. For example, by regulating banks, the Fed helps prevent the kind of risky behavior that sparked the 2008 crash, while its payment oversight ensures commerce keeps flowing smoothly.

The Fed doesn’t control the economy directly, but it wields powerful tools to steer it. At the heart is open market operations, where the Fed buys or sells government securities to adjust the money supply—pumping in cash to lower rates during slowdowns or pulling it out to cool inflation. The discount rate is another lever: it’s the interest charged on loans to banks, setting a ceiling for short-term rates. Reserve requirements dictate how much banks must hold in reserves, though these have been set to zero since 2020 for flexibility.

In tougher times, the Fed turns to unconventional tactics like quantitative easing (QE), buying up bonds and other assets to flood the system with liquidity. It also pays interest on reserves banks hold with it, encouraging them to park money safely rather than lend recklessly. Here’s a breakdown of these tools in a simple table to show how they work:

| Tool | Description | Primary Goal | Example in Action |

|---|---|---|---|

| Open Market Operations | Buying/selling U.S. Treasury securities to influence reserves and rates. | Adjust money supply and interest rates | QE during 2008 crisis expanded balance sheet to $4.5 trillion. |

| Discount Rate | Rate for short-term loans to banks from the Fed’s “discount window.” | Provide liquidity in emergencies | Lowered to near zero in 2020 pandemic response. |

| Reserve Requirements | Minimum reserves banks must hold against deposits (currently 0%). | Control lending capacity | Eased post-2008 to encourage lending. |

| Interest on Reserves | Payments to banks for holding reserves at the Fed. | Set floor for short-term rates | Used to manage rates without selling assets. |

| Quantitative Easing | Large-scale asset purchases beyond Treasuries, like mortgage-backed securities. | Stimulate economy when rates are low | Multiple rounds from 2008-2014 and during COVID-19. |

These instruments give the Fed flexibility, but they’re not without controversy—critics argue QE can inflate asset bubbles or favor Wall Street over Main Street.

The Fed’s actions might seem abstract, but they hit close to home. When it raises rates to fight inflation, borrowing gets pricier—think higher car loan or credit card payments—but it can also strengthen the dollar and curb rising prices at the grocery store. Lower rates, on the other hand, spur spending and job growth, making it easier to buy a home or start a business. During the COVID-19 era, the Fed’s massive interventions helped avert a deeper recession, though they contributed to later inflation spikes that peaked in 2022.

On a macro level, the Fed promotes financial stability, which prevents bank failures from snowballing into depressions. Its regulatory role, beefed up by the 2010 Dodd-Frank Act, includes stress tests for big banks to ensure they can weather storms. Without the Fed, we’d likely see more volatile swings, higher unemployment during downturns, and less efficient payment systems that could slow down everything from paychecks to online shopping.

As we wrap up 2025, the Fed has been navigating a tricky landscape. After aggressive rate hikes starting in 2022 to tame post-pandemic inflation—fueled by supply chain snarls and global events like the Ukraine conflict—it began cutting rates in mid-2024 as price pressures eased. But political tensions have ramped up, with President Trump pushing for deeper cuts and even attempting board changes, sparking debates over the Fed’s cherished independence. Meanwhile, innovations like FedNow continue to evolve, aiming for faster, safer payments in a digital age.

These moves underscore the Fed’s ongoing balancing act: responding to economic data while fending off external influences. For investors, staying tuned to FOMC announcements can signal when to refinance a loan or adjust your portfolio.

Grasping what the Federal Reserve is and does isn’t just trivia—it’s practical knowledge that can inform your choices. If rates are rising, it might be time to lock in a fixed mortgage or shift investments toward bonds. In low-rate environments, stocks often thrive, but watch for inflation risks. Tools like the Fed’s own economic projections or apps tracking the federal funds rate can help you stay ahead.

Ultimately, the Fed exists to foster a stable environment where businesses grow and people prosper. By demystifying its operations, you’re better positioned to weather economic shifts and make smarter moves. For deeper dives, check official resources or consult a financial advisor tailored to your situation—the Fed’s work affects us all, but how you respond is up to you.