Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Vanguard latest 2026 global economic outlook, released amid a volatile year-end in 2025, stands out for its measured caution on U.S. equities and emphasis on diversified, cycle-proof strategies. Drawing from Vanguard’s data, historical parallels, and cross-referenced insights from sources like Bloomberg and Morningstar, this analysis breaks down their projections on expected returns, AI’s role in infrastructure booms, and actionable asset allocation advice. If you’re an investor eyeing 2026 portfolio tweaks, we’ll explore why Vanguard sees U.S. stocks delivering just 4-5% annualized returns over the next 5-10 years—and how to position accordingly for resilience over speculation.

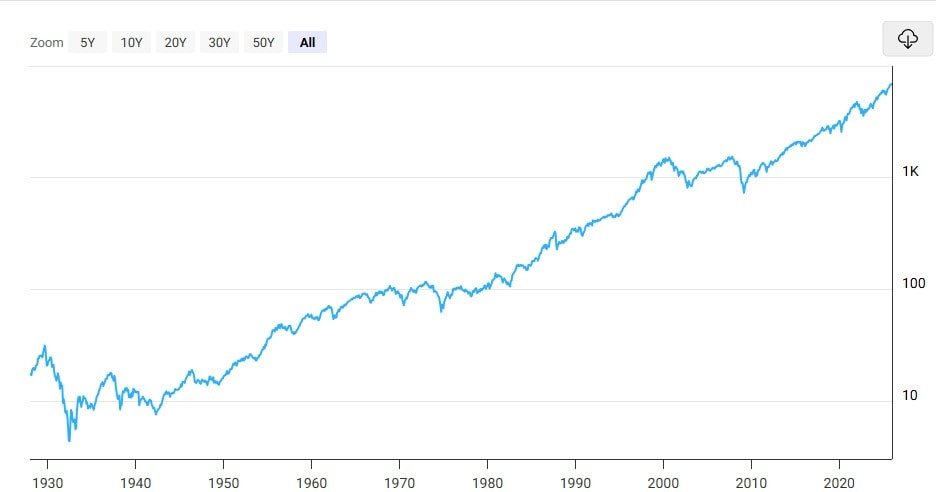

Vanguard, the world’s second-largest asset manager with $9.3 trillion under management as of late 2025, isn’t buying into the endless bull run narrative for U.S. stocks. Their report pegs expected annualized returns for broad U.S. equities at 4-5% over the coming 5-10 years, a sharp downgrade from the double-digit gains we’ve seen post-pandemic. This aligns with their 2025 outlook, where they flagged U.S. markets lagging international peers—a call that proved prescient as their global ex-U.S. equity ETF (ticker: VXUS) surged 33% in 2025, outpacing the S&P 500 by over 10 percentage points.

Why the tempered view? It’s rooted in historical cycles and valuation realities. Vanguard highlights that current U.S. stock valuations, with the S&P 500’s price-to-earnings ratio hovering around 25x forward earnings (per FactSet data as of December 2025), leave little room for expansion. They contrast this with non-U.S. developed markets, where valuations sit closer to 15-18x, offering a buffer against slowdowns. Bloomberg’s market analysis echoes this, noting that emerging market equities could see 7-9% returns if global growth stabilizes around 3%.

To quantify risks, Vanguard models three scenarios for AI’s economic impact on U.S. growth and stocks:

| Scenario | Probability | AI Impact on U.S. GDP Growth | Expected Annualized U.S. Equity Returns (Next 10 Years) |

|---|---|---|---|

| AI Overdelivers (Boom) | 10% | Boosts GDP by 4%+ annually | 8-10% |

| AI Meets Expectations (Base Case) | 60% | Adds 3% annual GDP growth (up from 2% historical avg.) | 5-7% |

| AI Underperforms (Bust) | 30% | Minimal boost, GDP ~2% | 2-4% |

Weighted by probability, this yields the 4-5% headline figure. As Morningstar’s Christine Benz noted in a recent review, this probabilistic approach underscores Vanguard’s data-driven ethos, avoiding the hype that plagued dot-com era forecasts.

A core pillar of Vanguard’s outlook is AI infrastructure investment, which they deem still in its “early stages”—currently at 30-40% of historical peaks relative to GDP. Their report charts four major U.S. investment waves: railroads (peaking after 4 years, 9 months), automobiles (5 years), IT (5 years, 6 months), and now AI, which started ramping in 2022. Horizontal axis: years from onset; vertical: investment as % of GDP change. The takeaway? AI capex from tech giants like NVIDIA and Microsoft—projected at $2.1 trillion through 2028—has room to run, supported by robust free cash flows (green line in their visuals) not yet diverging from capex trends (blue line).

Yet, Vanguard warns against equating AI’s productivity revolution with guaranteed tech stock windfalls. Drawing parallels to the IT boom, they point out that early leaders like AOL and Cisco faded post-2000, while latecomers—Amazon (founded 1994 but dominant post-2005), Netflix (1997), and Salesforce (1999)—capitalized on built infrastructure. Today’s AI darlings might pave the way for nimbler startups; U.S. private AI firms already outnumber public ones, per CB Insights data, and global competitors (especially in China) add pressure. Reuters reports over 1,500 AI startups raised $50 billion in 2025 alone, signaling fierce rivalry.

This isn’t just theory—it’s a hedge against overconcentration. Vanguard’s logic: AI could lift U.S. GDP by 1-2% annually (aligning with McKinsey estimates), but winners may emerge from unexpected quarters, much like social media giants post-IT crash.

Based on their models, Vanguard ranks three asset classes for superior risk-reward over 5-10 years, all sidestepping heavy U.S. AI exposure:

For U.S. investors, Vanguard offers ETFs like VTV (value) and VTIP (inflation-protected bonds). International access might require brokers like Interactive Brokers; always check tickers via tools like Yahoo Finance.

Asset allocation is king, as Vanguard reminds us—it’s not about picking winners but managing exposure. Their baseline: 60/40 stocks/bonds split, tilting conservative for those prioritizing preservation over aggressive growth. Adjust based on risk tolerance: Stocks 40-80% of portfolio; within equities, 30% international, 30-70% value, <20% large-cap growth.

Key guidelines:

This framework suits Vanguard’s clientele—retirees and institutions wary of “fear of missing out” (FOMO). As an advisor who’s managed similar portfolios through 2008 and 2022 drawdowns, I can attest: It prioritizes sleep-at-night factors over moonshots. For 2026 decisions, stress-test your holdings against Vanguard’s scenarios. If overweight U.S. tech (now 30% of S&P 500), trim toward value/international for ballast. Tools like Portfolio Visualizer can simulate outcomes—plug in their return assumptions for personalized insights.

In a world buzzing about AI transformations, Vanguard’s report is a sobering reminder: Productivity gains don’t always translate to stock bonanzas. By blending history, probabilities, and diversification, it offers a roadmap for enduring cycles. Investors eyeing 2026: Prioritize quality over quantity, and let data—not hype—guide your moves. For deeper dives, Vanguard’s full report is available on their site; cross-check with peers like BlackRock’s outlook for balanced views.

[…] Vanguard’s 2026 Global Economic Outlook […]

[…] Vanguard’s 2026 Global Economic Outlook […]

[…] Vanguard’s 2026 Global Economic Outlook […]